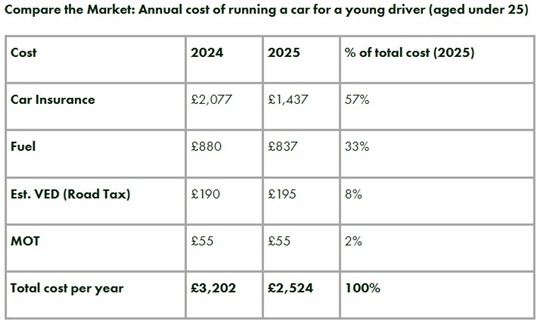

Car insurance premiums for drivers aged under 25 have dropped by £640 on average year-on-year from £2,077 to £1,437. Young motorists typically pay £2,524 to drive a car for a year in 2025, compared to £3,202 in 2024. Shopping around ahead of insurance renewal is one of the best ways to see which new deals are available

|

The average cost of driving for young motorists, aged under 25, has fallen by £678 in the past year, according to the latest Young Drivers research from Compare the Market. The decline in the cost of driving is mainly due to a drop in the average car insurance premium which decreased to £1,437 in March 2025, compared to £2,077 in the same month last year.

The average premium in March 2024 (£2,077) was the peak in the cost of car insurance for young drivers, with premiums generally declined since then. The decline in motor premiums may in part be due to a stabilisation in the cost of claims for insurers.

The total yearly cost of running a car for young drivers is now £2,524 on average. This represents a significant decrease in comparison to last year when the average running cost was £3,202. As well as falling insurance costs, the decline in overall car running costs has also been driven by a year-on-year drop in the cost of fuel due to lower global oil prices. Car insurance now represents 57% of the total car running costs for young drivers compared to 65% last year.

As premiums are declining, young drivers who shop around before renewing their car insurance could find some great deals. By comparing prices online, motorists could also save money by shopping around for MOT, servicing, and repairs services with access to thousands of garages nationwide through Compare the Market.

Guy Anker, Insurance Expert at Compare the Market, comments: “Young drivers will be pleased that the cost of driving, including car insurance has fallen significantly. Despite this, it is still a good idea for all motorists to compare insurance prices online first, before renewing. Through proactively shopping around, young drivers could save by switching or finding a deal that is more suitable for their circumstances such as a telematics or pay by mile policy.”

|