The quarter was dominated by a succession of storms hitting the UK causing widespread property damage, with £352 million being paid out to support customers whose homes were damaged by Storms Babet, Ciaran and Debi alone.*

“The succession of storms that have battered the UK in recent months underlines the importance of home insurance, with insurers supporting thousands of customers whose homes and possessions have been damaged or destroyed. Despite rising cost pressures, insurers are totally committed to doing everything they can to continue to offer competitively priced home insurance”

said Louise Clark, ABI’s Policy Adviser, General Insurance.

The ABI’s Tracker covers over 16 million policies and is the only survey that looks at the price consumers actually pay for their cover, rather than the price they are quoted.

The figures show that between 1 October and 31 December:

The average premium paid for a combined buildings and contents policy was £364 up £14 (4%) on the previous quarter. In the year ending Q4 2023 the average premium rose by 19%. For 2023 as a whole, the average premium rose by 13% to £341.?

The average buildings only policy was £284, up £12 (4%) on the previous quarter. Over last year, the average premium increased by 15% to £262.?

For contents only cover, the average price paid at £131 rose £5 (4%) on the previous quarter. Over the last year, the average premium rose 7% to £124.

Insurers battling cost pressures to deliver value for money home insurance.

Bad weather. Insurers paid out £352million, dealing with 36,000 claims to their home insurance customers following Storms Babet, Ciaran, and Debi. These were three of the six named storms that hit the UK in the last quarter of the year, along with a tornado in Manchester. The full insured costs of these storms will not be known for several months. The beginning of the year also saw a surge in burst pipe claims following a cold snap.

Increasing rebuilding costs. The House Rebuilding Cost Index (HRCI) compiled by the Building Cost Information Service measures changes in the price of rebuilding costs, such as the price of raw materials and labour costs. In the two years to January 2024 the Index rose by 21%, further impacting on the cost of repairing people’s homes.

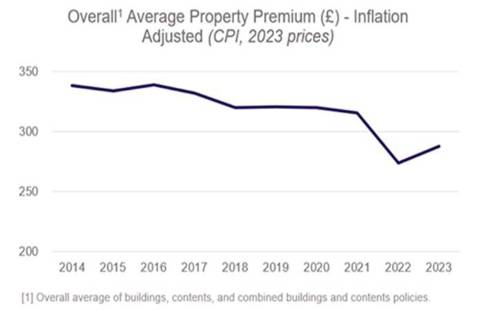

Despite rising costs, home insurance remains competitively priced. When adjusted for inflation, the average price of cover has actually fallen between 2014 – 2023. During 2017 – 2022, the average cost of claims rose by 6% in real terms.

Louise Clark added: “Flooding caused by extreme weather is devastating when it strikes people’s homes. That’s why it is vital more is done to increase investment in flood risk management that better protects communities which are at risk, alongside a zero-tolerance approach to building properties in areas of high flood risk.”

|