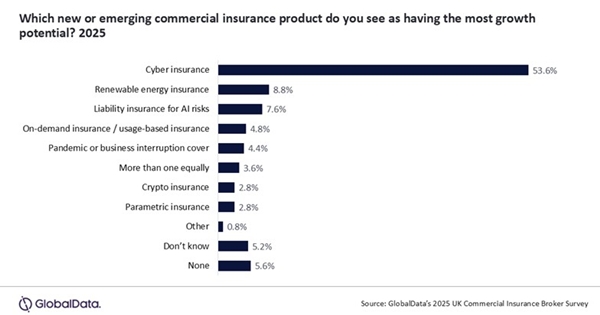

GlobalData’s 2025 UK Commercial Insurance Broker Survey reveals that over half of brokers (53.6%) believe cyber insurance has the potential to record the strongest growth among new or emerging commercial insurance products. Cyber insurance significantly surpasses the potential of other emerging products, with renewable energy insurance—the second-most popular product—attaining 8.8% of responses.

Beatriz Benito, Lead Insurance Analyst, GlobalData, comments: “Both insurers and reinsurers are diversifying their strategies to tap into emerging risks, which will support growth in the cyber insurance market. A greater appetite around this line of business will help soften market conditions, as an increase in capacity can help insurers combat soaring premiums.”

Findings from GlobalData’s 2025 UK SME Insurance Survey reveal that 60.8% of SMEs do not hold cyber insurance. The most common reason for not holding such cover is because businesses believe it is unlikely that they will be a target of a cyberattack, as cited by 40.5% of SMEs.

Benito continues: “Despite the growing awareness of cyber risks among businesses, the adoption of cyber insurance is far from universal, with underinsurance remaining a key challenge to the industry. The protection gap is more pronounced among smaller businesses despite SMEs being more vulnerable of an attack. Insurers will need to tackle the protection gap through several fronts to grow the cyber insurance market. Focusing on conveying the impact that a cyberattack can have on a business—not only in terms of operations but also reputation—can be beneficial. Equally, there could be greater transparency on policy wording, making it clearer what the perils and exclusions are to avoid this being a barrier to buyers. Lastly, SMEs remain a largely untapped market and are often more vulnerable to attacks but have fewer resources to respond effectively. This makes them strong candidates for tailored cover, developing products that address their specific needs.”

|