|

|

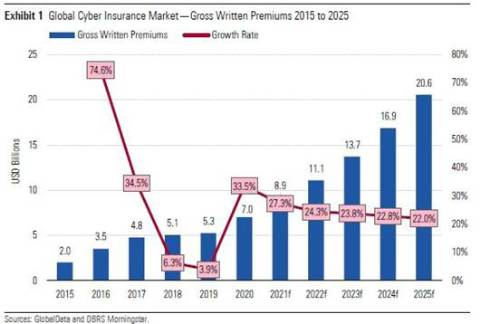

DBRS Morningstar published a commentary assessing the potential impact of cyberattacks on European and North American insurers’ and reinsurers’ volumes of cyber claims in the context of the Russia-Ukraine conflict and the recent tightening of economic sanctions on Russia, which could trigger retaliatory cyber warfare. |

Key highlights include the following:

The Russia-Ukraine conflict has already increased the number of cyber incidents, but they mostly remain unsophisticated distributed denial-of-service attacks.

Although acts of war are typically excluded from cyber insurance policies, attribution remains a key challenge as most cyber warfare is typically not acknowledged by belligerent state actors.

War exclusions in insurance policies have been updated in the past three years, but insurers and reinsurers are still trying to find a balance between the right coverage and managing accumulation risk.

In DBRS Morningstar’s view, claims should remain manageable for most insurance and reinsurance companies given updated exclusion clauses, reductions in limits, and product diversification.

“Although acts of war (declared or not) are typically excluded from cyber insurance policies, in DBRS Morningstar’s view, the current conflict could potentially increase cyber-related insurance and reinsurance claims in Europe and North America, as attribution can be very difficult to determine in cyber incidents,” said Marcos Alvarez, Senior Vice President and Head of Insurance. “Nevertheless, we expect that insurers and reinsurers will continue to clarify their cyber war exclusions to face the new realities of state-sponsored cyberattacks.”

|

|

|

|

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.