Catastrophic Damage: The western third of Jamaica experienced wind speeds in a 60-mile swath comparable to an EF-2 tornado, with coastal areas and mountainous populations experiencing EF-3 level winds. Preliminary imagery from western Jamaica depicts most homes uninhabitable, along with severe damage to commercial structures. For Kingston, the most populous region in Jamaica, Melissa was far enough west to bring only tropical storm force winds with initial reports of isolated damage.

Widespread Impacts: Information is limited from Melissa’s subsequent landfalls in Cuba overnight Tuesday and the Bahamas on Wednesday. With Melissa weakening significantly to category 3 status in Cuba and category 2 status across the Bahamas, initial expectations are for storm surge damage to low lying coastal areas and damage to older buildings and the most vulnerable structures.

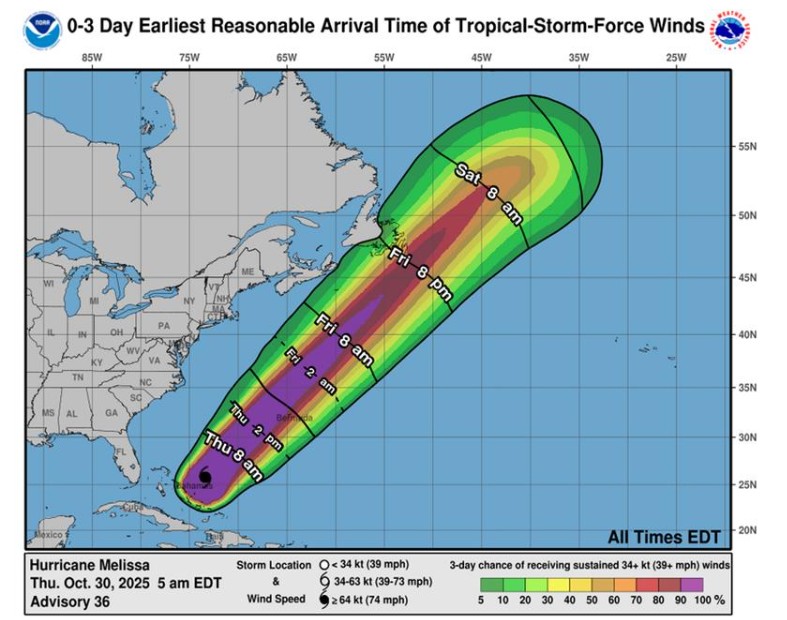

Source: National Hurricane Center. Expected arrival time of tropical storm force winds for Bermuda and Newfoundland.

The Forecast: Melissa is rapidly accelerating northeast away from the Bahamas. Hurricane warnings are posted for Bermuda, however model guidance suggests the hurricane will track far enough west that the island will likely see limited impacts consisting of tropical storm force winds with isolated gusts to near hurricane strength. In comparison to Hurricane Imelda’s strike on Bermuda earlier this season, Melissa is expected to not be as impactful for the island. After transitioning to a large extra-tropical cyclone beyond Bermuda, Melissa will bring gale force winds to Newfoundland tomorrow.

Insurance Implications: According to AM Best, insurance take-up rates in the western portion of Jamaica are quite low outside Montego Bay, on the order of 5%-10%. Thus, personal lines losses are anticipated to be mostly economic in nature rather than insured. Material damage in commercial lines properties, notably in the tourist destinations near the coast including Montego Bay, is likely insured by a mix of 17 registered carriers in Jamaica, as well as global carriers for larger properties.

For those carriers providing insurance in western Jamaica, AM Best expects reinsurers to pay most of the losses, given the significant reliance of Caribbean-based carriers on reinsurance. It is reported by Artemis that the USD 150 million Jamaican parametric catastrophe bond, called IBRD CAR Jamaica 2024, will provide funds for the country after being triggered. Ultimately, Melissa will be a severe economic loss event with a slim minority of damages covered by insurance, likely raising discussion around the growth of the protection gap between insured and economic losses.

|