Aggregate scheme assets increased slightly over June 2024, as equity markets continued their strong year to date, further boosting improvements in DB surpluses.

However, this increase in scheme assets was slightly offset by a small decline in long-term gilt yields of c.0.1%, leading to an increase in the value of liabilities.

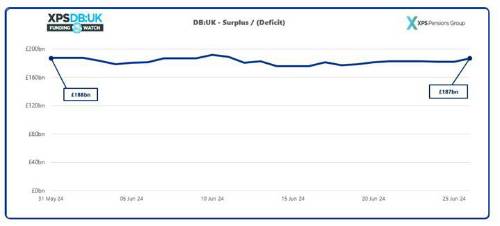

Over June 2024, UK pension schemes’ funding positions fell by c.£1bn, relative to long-term funding targets according to new research from XPS Pensions Group. With assets totalling £1,463bn and liabilities of £1,276bn, the aggregate funding level of UK pension schemes on a long-term target basis remains extremely positive, at 115% of the long-term value of liabilities, as of 26 June 2024.

Following the outcome of today’s general election, attention will soon focus on the future Government’s timelines for getting the draft funding code passed through Parliament as well as other topical issues such as options on the uses of DB scheme surpluses.

Henry Shore, Senior Consultant at XPS Pensions Group said: “Despite the uncertainty typically associated with the run up to general elections, surpluses have remained stable through June, and are at near-record levels since the start of the year. Trustees and sponsors should remain optimistic and develop strategies to best manage their strong surpluses, with insurance transactions and running on for surplus now viable options for many.

For those running on their schemes, the release of the new DB funding code will provide clearer guidance on the options available. Trustees and sponsors will therefore be hoping that the forthcoming Parliament will implement the funding code in alignment with the new Funding and Investment Strategy regulations commencing in September 2024, to minimise any potential uncertainties.”

|