By Alex White, FIA, Managing Director, Co-Head of ALM at Redington

But even for US firms this can be the case. Microsoft earns almost exactly half its revenue from outside the US (though the USD/non-USD split will be different). Large companies do not simply exist in one currency.

Secondly though, and perhaps more fundamentally, what does the risk look like?

Leaving equities unhedged would seem to add risk, but USD is often seen as the go-to safe asset in a crisis. If equities fall a long way, unhedged equities (for a GBP investor) could fare better than hedged equities, as everyone tries to buy dollars. This is evident when looking over the last 20 years or so - FX hedged equities have underperformed in drawdowns.

On a longer-term lens it’s more neutral and the optimal hedge ratio has been somewhere in the middle (which is also the ‘least wrong’ approach in any eventuality).

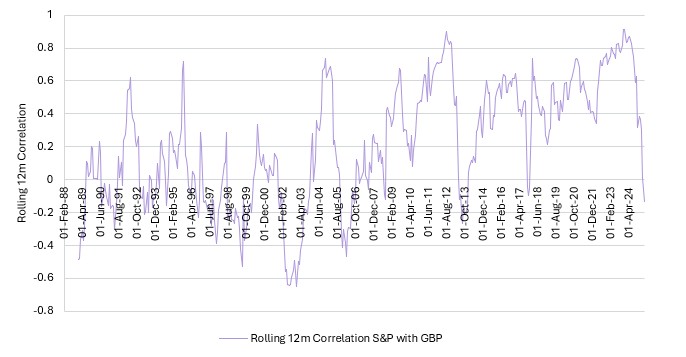

We can also see something similar with rolling 12-month correlations between the S&P500 TR and GBPUSD. While the data is noisy, there is a general trend for GBP to do better in bullish environments and worse in bearish ones, with a whole period correlation of 22% .

This is similar to the correlation when equity moves down (21%) or up (25%). There’s also a fairly dramatic plunge in the correlation happening now, from over 80% to negative, in the fallout from US tariffs.

Source: Reuters, Redington, April 2025

So, what about when things really go wrong?

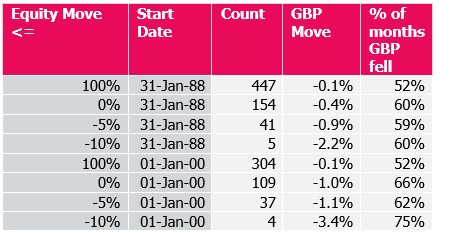

We look at months in which equities moved beyond a certain threshold, count how many months that’s been and see how GBP performed (on average) in those months:

There is not much data in the tails, so any conclusions should be tentative. That said, GBP has seen larger downside moves than upside moves.

Even including the 14% fall over Brexit, the next largest fall was 11% in 1992, while the largest gain was 9% in May 2009, after some large falls through the financial crisis. There could well be something in the ‘safe haven’ hypothesis.

Over the tariff period though, this effect reversed, with large falls in equity markets and proportionate falls in USD. In this particular market event, USD did not behave as a safe currency.

What could be happening? There are broadly three hypotheses:

1. There’s no link and it’s all random (this is possible, though not the obvious conclusion from the data)

2. USD was and is seen as the safest currency and this is just noise

3. USD is no longer automatically seen as the safest investment

Whatever probability you ascribe to these options, if no.3 seems more likely than it did before, then Bayesian investors should consider increasing FX hedge ratios in equities. Otherwise, their portfolios could face a tragedy.

|