The UK’s fiduciary management market has entered a new phase of maturity and strategic importance as it supports more defined benefit (“DB”) pension schemes towards their endgame. Isio’s Latest Fiduciary Management Survey reveals that insurance transactions - particularly buy-ins - among schemes run by fiduciary managers have surged in 2025, more than doubling year-on-year to capitalise on improved funding positions and favourable pricing conditions.

Despite this rapid shift toward insurance, overall fiduciary market activity remains robust. Total assets under management (“AUM”) remain broadly the same at £241bn in 2025 (vs £242bn in 2024), while total mandates have decreased by 4% (down from 865 in 2024 to 832 in 2025).

Over 60 new mandates were awarded over the 12 months to 30 June 2025 – largely through full delegation – while partial-mandate assets managed increased by 4% (from £65bn up to £68bn). Large Outsourced Chief Investment Officer (“OCIO”) arrangements continued to expand and now account for over half (53%) of total fiduciary assets in the UK defined benefit fiduciary management market, helping offset the impact of scheme exits following insurance transactions.

Endgame momentum defines the FM market

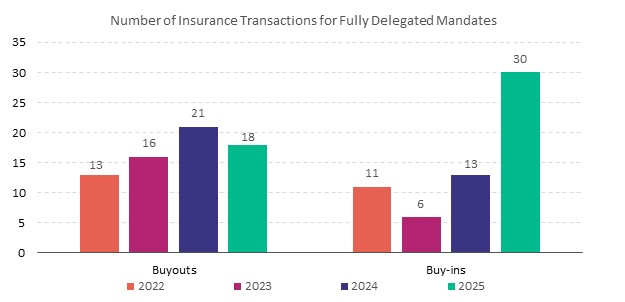

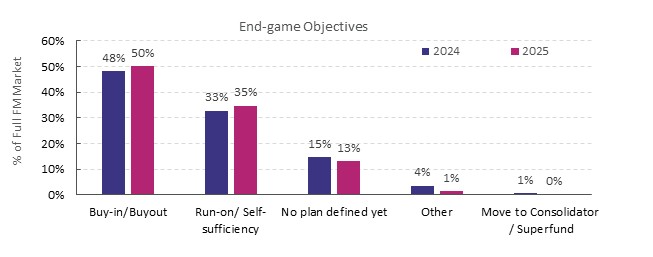

Half of schemes (50%) are targeting insurance-based long-term objectives, reflecting an industry-wide pivot towards risk transfer. The volume of buy-ins has more than doubled (131%) from 13 in 2024 to 30 in 2025, while the number of buyouts remained broadly stable. Almost half (48%) of the reduction in FM mandates over the past year is directly attributable to insurance transactions.

The sharp rise in insurance activity highlights how fiduciary managers are supporting schemes through the transition to endgame – first and foremost in preparing portfolios for transaction. Alongside this, run-on strategies are gaining momentum as schemes with surpluses choose to retain control of assets and manage them for long-term value. Fiduciary managers are responding with cashflow-driven investment (“CDI”) solutions and flexible growth strategies that balance liquidity with return potential.

Improving funding levels underpin the shift

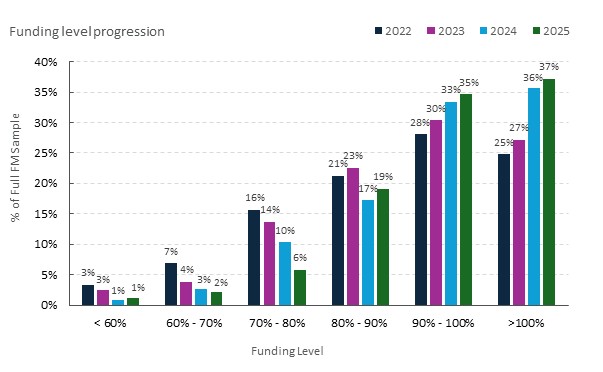

Almost three-quarters (72%) of FM mandates are now funded above 90%, and over one-third (37%) are fully funded and in surplus on a Technical Provisions basis, representing a 44% increase in fully funded schemes over the past three years. These improved funding levels have given trustees greater freedom to implement long-term objectives, whether through insurance transactions or run-on strategies. As schemes close deficits and move from recovery to surplus management, fiduciary managers are helping clients translate funding strength into portfolio resilience and readiness for insurer engagement.

Simplifying portfolios and refining strategies

As schemes mature and funding levels improve, fiduciary portfolios are becoming simpler, more liquid and more cost-efficient. On average, equity allocations have increased by around 4% to 23% compared with 2024, the largest equity allocation we have observed in recent years, while allocations to illiquid assets have fallen by approximately 2%. Fiduciary managers continue to favour traditional growth assets supported by derivative strategies that mitigate downside risk without compromising liquidity.

The use of active management has declined (8%) year-on-year, reflecting cost discipline and a reduced appetite for complex, higher-fee approaches. More than half (58%) of mandates now target returns of liabilities +1.5% per annum or below – a sign of a market focused on low-risk portfolios that support insurance or run-on outcomes.

Paula Champion, Partner and Head of Fiduciary Management Oversight at Isio, comments: “This is the first time we have not seen major fiduciary mandate and asset growth since 2008, reflecting the higher numbers of defined benefit schemes taking advantage of improved funding positions and the greater variety of endgame options available to them. Despite this trend, the fiduciary management market has proven remarkably resilient, through a notable expansion of partial and OCIO mandates. Fiduciary managers are playing integral roles supporting defined benefit schemes in their journeys towards their endgame. Their importance can be seen in the combination of a sharp rise in insurance transactions and flat year-on-year numbers for total fiduciary management assets and a marginal reduction in mandates.

“Fiduciary managers are responding to more schemes accelerating their endgame plans by focusing on insurer-ready portfolios, cost-efficient structures and governance frameworks that deliver clarity and control. They continue to demonstrate true value, helping schemes complete their endgame confidently while safeguarding member outcomes. For many trustees who choose to delegate their investment decision-making, a fiduciary approach can provide a high standard of portfolio management and governance for schemes targeting run-on.”

|