Phoenix Group’s longevity think Phoenix Insights has published its latest report outlining policy recommendations and a roadmap for the government’s upcoming review of retirement adequacy in the next phase of its pension review. Urgent policy change is needed to address widespread under saving in the UK and the review provides a golden opportunity to assess the retirement landscape to improve people’s future.

Modelling from Phoenix Insights suggests as many as 17 million UK adults are not on track to retire when they want to on the income they want**, and projections show the under-saving crisis will come to a head in the next two decades with people retiring in 2030s and 2040s the least financially prepared for life after work***.

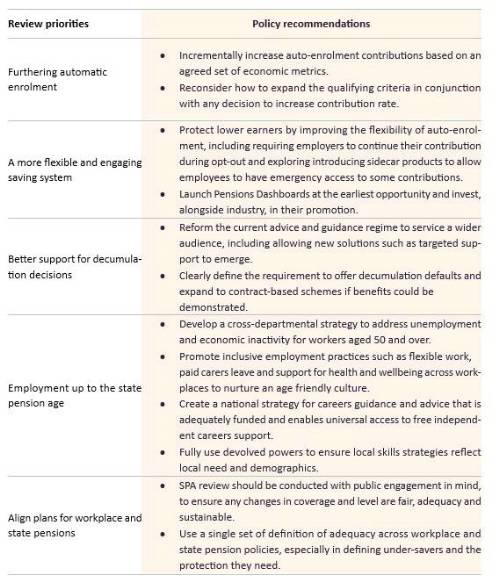

The government has not yet published its approach to the adequacy review but ahead of this Phoenix Insights recommends five priority areas it believes should be included to improve the retirement of future generations. These are: furthering pensions auto-enrolment, a more flexible and engaging saving system, better support for decumulation decisions, employment up to the state pension age, and the future of the state pension.

Catherine Foot, Director of Phoenix Insights, Phoenix Group’s longevity think tank, comments: “The government’s commitment to assess retirement adequacy is a critical opportunity to set out a plan to tackle under-saving and improve the retirement prospects of future generations. As many as 17 million people are not saving enough to achieve the retirement they want, and the next two decades is when the effects of the savings crisis will really start to bite.

“Any changes will have a long-term impact so it’s important the review looks at the retirement landscape as a whole and how the different policies work together. This should include a review of the private and state pension systems to ensure people can achieve an adequate retirement income, and addressing how people engage with their saving and draw money from their pension.

“For people in their 50s and 60s, being in work can be the difference between having financial security or not later in life, so we believe the review should also look at how we can better support the over-50s to remain in work and continue to earn and save if they want to or need to.”

Gail Izat, Managing Director for Workplace Pensions at Standard Life, part of Phoenix Group, said: “It’s good to see savings adequacy form a key part of the new government’s Pensions Review. The vast majority of people now save for retirement via auto-enrolment (AE) and we hope extension of the scheme will feature prominently.

“The single biggest lever we can pull to boost savings adequacy is to increase minimum AE contributions as while opt-outs have remained low, most people leave their pension contributions at the 8% minimum which in most cases is not enough to secure a decent standard of living in retirement. There are international examples of higher minimum contributions strengthening savings adequacy – in Australia, for example, contributions will rise to 12% next July and people have a higher anticipated standard of living compared to the UK.

“It’s difficult to predict what the future will look like but we do know that without action to help people save now we risk sleepwalking into a retirement crisis. It’s also important that future reform pays due regard to people who might struggle to pay higher contributions and to employers, and we’d like to see the Review take a fully joined-up approach with consideration made to workplace, personal and state pension provision as well as the wider economic environment.”

Phoenix Insights: 5 priority areas and recommendations for the government’s retirement adequacy review

*DWP (July, 2024), Chancellor vows 'big bang on growth' to boost investment and savings

**Phoenix Insights (March, 2022) Longer Lives Index

***DWP (March, 2023), Analysis of future pension incomes

|