If you are making retirement plans based on living to around average life expectancy, you need to think again.

Fewer than half of today’s 65-year-olds are expected to die within five years either side of their average life expectancy, official figures show. Fixating on life expectancy obscures outcomes that are more likely, according to retirement specialist Just Group.

“Applying average life expectancy figures to retirement planning doesn’t work because of the simple fact that individual people are very unlikely to be average,” said Stephen Lowe, group communications director at retirement specialist Just Group.

“A better option is to think about the ‘what ifs’ of later life and to prepare for the range of possibilities. There are really three potential outcomes – you die around average life expectancy, you die sooner, or you live longer. A robust retirement plan needs to cover those three bases.”

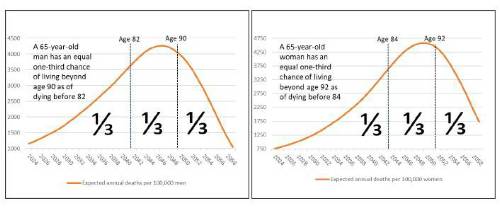

Official life tables give future expected mortality rates for each age group and gender. These can be used to calculate the probability of members of that age group or gender surviving up to age 100. The charts below are split into three groups of equal number, reflecting a one-third chance of each outcome.

For the cohort of men aged 65 in 2024, about one-third are expected to die before age 82, another third to die between 82-90, and the longest-lived third to survive beyond age 90.

For women aged 65 in 2024, about one-third are expected to die before age 84, another third to die between 84-92, and the longest-lived third to survive beyond aged 92.

“None of us know how long we are likely to live and these charts remind us why we shouldn’t assume that we’ll be somewhere in the middle,” said Stephen Lowe. “Expecting to survive to around average life expectancy – the middle third of your age cohort – actually gives a two-thirds chance you will be wrong which are not good odds when planning your finances.”

He said that the figures reinforce the importance of planning for each eventuality including early death and living well beyond the average.

“With annuity rates well above 6% for a 65-year-old, the current likelihood is that more than two-thirds of people will get their investment back or more as secure income, while the other third should not miss out because annuity payments don’t have to stop on death. Options such as joint-life annuities, guaranteed periods and value protection can ensure money continues to be paid out after an annuitant dies.

“As a retirement expert, providing guaranteed income for life solutions, we know that people worry about losing their investment if they die too soon but buying should never feel like a bet you can only win if you are lucky enough to live to a great age.

“Annuities are primarily about ease and peace of mind. They require no ongoing management, provide security to spend the income without worrying if it will run dry, along with the certainty that loved ones can benefit if the worst happens.”

Just Group specialises in analysing individual’s lifestyle and medical information to calculate personalised

annuity rates that can be much higher than standard rates.

“Most people know smokers can get higher annuity rates to reflect lower than average life expectancy but our underwriting process is so sophisticated it takes into account hundreds of different factors,” said Stephen Lowe.

“No-one is average so no-one should be accepting average annuity rates.”

Annuity buying tips:

• www.moneyhelper.org.uk – the government’s money and pensions guidance service offers access to free, independent and impartial guidance service Pension Wise and also has a useful online tool allowing quick comparisons of annuity rates and options.

• Employ an expert – an annuity broker or regulated adviser will work with you to better understand your goals, to choose the right options and shop around for the best deal.

• Full disclosure – providing details of your lifestyle and medical history is the only way to get a personalised annuity rate based on your unique situation.

• Don’t settle for less – seek out the highest offer because small differences in annuity offers can add up to large amounts over a long retirement.

|