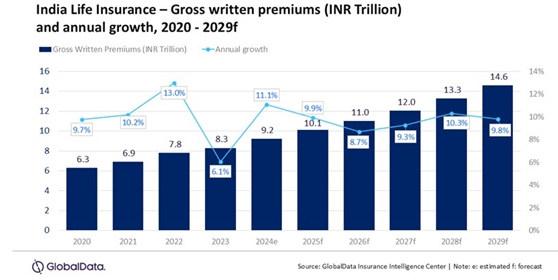

GlobalData's India Life Insurance Report indicates that the Indian life insurance market is estimated to reach INR10.1 trillion ($120.5 billion) in GWP by 2025, reflecting an annual growth rate of 9.9%. Factors supporting this growth include increased financial literacy, digitalization, and a growing focus on tailored products. This growth is also underpinned by a shift in consumer preferences towards whole life and term insurance products, with the latter gaining traction among younger generations.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: “The Indian life insurance sector is evolving rapidly, with favorable regulatory developments and a notable increase in participation from women and marginalized communities. The introduction of women-centric products reflects the industry's responsiveness to the unique needs of these demographics. Furthermore, government initiatives like the 'Bima Sakhi Yojana' are crucial in promoting financial literacy and insurance awareness, particularly in rural areas."

India's demographic landscape is undergoing a transformative shift, characterized by an increase in the working-age population. The larger working-age population, with increased income levels and savings potential will foster a culture of financial planning and risk management, supporting demand for life insurance products with better or guaranteed returns. Furthermore, the increasing participation of women in the workforce, particularly in urban areas, is expected to contribute to the demand for such products. Additionally, the introduction of tailored women-centric insurance plans is expected to enhance financial security for women and support growth, with insurers recognizing the growing demand for such products.

The push for rural inclusivity in the insurance market will also drive the Indian life insurance market, as it remains under-penetrated, with a penetration rate of 3.8% compared to Asian peers such as Hong Kong (15.4%), South Korea (7.1%), and Japan (6.5%) in 2024. Initiatives like the Bima Vistaar product (a comprehensive insurance product covering death, health, accidents, and property damage at an affordable premium), launched in April 2025, aim to provide affordable insurance coverage to rural populations and are expected to enhance accessibility.

Sahoo adds: “Collaborations between insurers and microfinance institutions, as well as partnerships with postal services, are set to broaden the reach of life insurance products, thereby increasing premium contributions from rural areas.”

Favorable regulatory changes will further support the growth of life insurance premiums. In the Union Budget for FY2025–26, the government proposed increasing the Foreign Direct Investment (FDI) limit in insurance from 74% to 100%. Additionally, there is a proposal to decrease the Goods and Services Tax (GST) rate on life and health insurance from 18% to 12%. Upon implementation, it is expected to enhance the affordability of life insurance.

The Insurance Regulatory and Development Authority of India’s (IRDAI) initiatives under its universal insurance coverage by 2047 program, such as AI-driven platforms and the Bima Sugam portal, will streamline processes and improve customer engagement. These initiatives will further boost demand for life products.

Sahoo concludes: "The outlook for the life insurance market in India remains positive, with growth driven by robust economic expansion, heightened financial literacy, and evolving consumer preferences. Regulatory reforms are expected to enhance consumer confidence. The emphasis on affordable microinsurance will further broaden the customer base, positioning India as one of the leading markets in the global life insurance landscape."

|