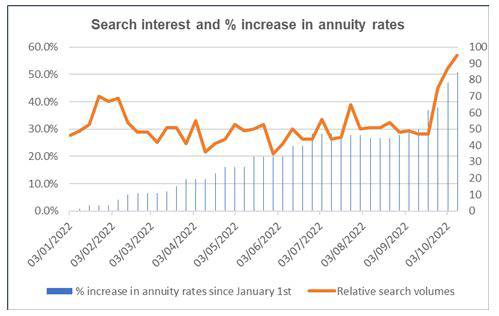

New analysis from Standard Life shows increasing interest in annuities as rates climb by around 50% since the start of the year. Analysis of Google Trends data, which provides an insight on the relative volume of searches on any term, highlights growing interest in annuities.

At the start of this year, the annuity rate for a healthy 65 year old, based on a typical postcode, was 4.66%. This had steadily risen to 7.04% by the second week of October.

The 51% improvement in rates has not gone unnoticed by those considering their retirement income options and the three highest weeks for search volumes have occurred since the end of September when rates crossed 6.44%.

Graph showing Google Trends data on ‘annuity’ searches since January 2022, compared to the increase in annuity rates for the Top 1 Provider since January 2022.

Claire Altman, Managing Director for Individual Retirement Solutions at Standard Life, comments: “The rise in annuity rates has clearly not gone unnoticed by those considering their retirement income options. Rates have been on a steady upward trend since the start of this year and at the levels we’re seeing now, we expect growing numbers of people to buy a guarantee on some or all of their retirement income.

“In the current climate, against a backdrop of rising inflation and a cost of living crisis, the benefits and value of a secure income to consumers are very attractive.

“We know that people still value flexibility when it comes to managing their retirement income, and if people annuitise in stages, leaving a portion of their income in drawdown, they get the best of both worlds. This ensures people still benefit from the potential of investment growth, but are secure in the knowledge that a portion of their income is guaranteed.

“As we move towards a future where more people will be relying on defined contribution to fund their retirement, it’s vital that people are aware of the different options available to them and are able to manage the challenges that come with being responsible for their retirement income.”

|