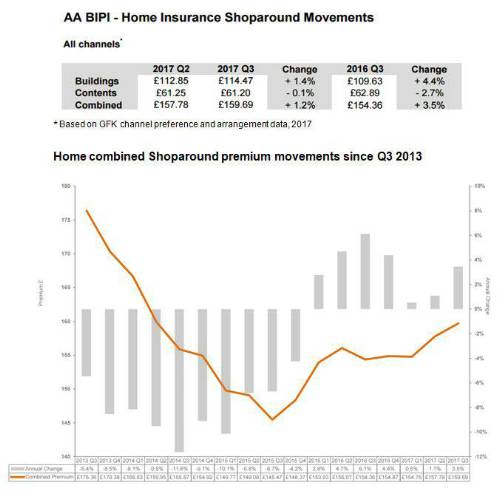

The Shoparound(1) data – based on the five cheapest quotes for each customer in a nationwide ‘basket’ of home policies, shows that the average quote for a combined buildings and contents policy has risen, but by less than £2 (or 1.2%) to £159.69, over the three months ending 30 September.

The rise was driven by an increase in the quoted premium for a standalone buildings policy of 1.4%.to £114.47 over the same period, although the typical cost of a contents-only policy dropped by a modest 5p (0.1%) to £61.20.

Over 12 months a typical price of a combined policy has increased by just 3.5%, accounted for by the increase in Insurance Premium Tax.

Michael Lloyd, the AA’s director of insurance says: “These are very small price changes that reflect the competitive nature of the market and represent very good value for householders.

“Premiums have remained low for a long time and there is some evidence to suggest that they aren’t keeping pace with developing risks such as potential weather damage and flooding.

“But if the recent storms are a portent for a severe winter to come, then we can expect home owners to feel the pain of rising premiums and not just those whose homes are been damaged or flooded.

“Insurance has become highly price-sensitive to the point that there is less consideration of the quality of the cover and what it provides which doesn’t serve customers well. Nevertheless, the industry has a good reputation for responding well to those who need immediate help.

“Despite the relative lack of premium movement over the last quarter, the trend is upwards – albeit modestly so.

Lloyd is also concerned that Insurance Premium Tax (IPT) remains a potential target for the Chancellor.

“Although I have no direct evidence that there will be an IPT increase this November, the Treasury has previously suggested that IPT and VAT should be more closely aligned. I recognise that the government has budget shortfalls and I hope the relative lack of premium movement in the home insurance market doesn’t encourage him to try to fill the holes by taxing responsible people trying to protect their of homes.”

• Modest buildings rise reflects slowing upward trend, AA Index shows

• Contents cover cost falls

• Stormy winter could push up prices

Home insurance premium movements – third quarter 2017

|