By Mitul Magudia, Chief Origination Officer, PIC

This is important because of the current policy proposals to release ‘surplus’. However, the ephemeral nature of DB pension scheme funding levels, compounded by the Bank of England’s stated objective of starting quantitative easing again should economic circumstances require it, should be considered. Remember, one of the impacts of QE was to push gilt yields to ultra-low levels, creating record deficits in many schemes.

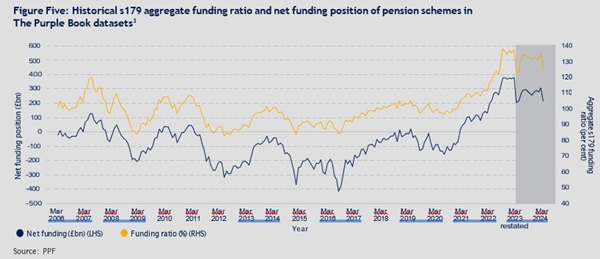

Under QE most DB pension schemes were in deficit (see figure five). In fact, sponsors paid in £200 billion in extra contributions into pension funds to cover deficits.(1) We should ask how long current positive DB pension scheme funding levels will last and whether it is safe to reduce DB pension scheme funding levels based on a short-term snapshot, especially where the stated path of future monetary policy could potentially create deficits once again.

Working on the basis that QT has increased rates at least around 50 bps(2), we estimate that liabilities are around 7 per cent lower than would otherwise be the case. If interest rates were to come down either through halting QT, or a restarting of QE, we would see liabilities increase. The current positive DB pension scheme funding levels could rapidly disappear.

Now that the Government has confirmed that they expect surplus extraction from defined benefit pension schemes to begin in 2028, this situation should come more sharply into focus. By 2028, after three more years of QT, the 50-bps temporary uplift to scheme funding levels QT has given will have unwound.

Trustees will know that the current positive DB pension scheme funding levels are likely to be temporary and many of them have sought to hedge or otherwise lock in their position. The question then is what they are hedging for, whether that is seeking to protect funding positions from the adverse effects of inflation, interest rate movements, or something else. No scheme is perfectly hedged, and without a dynamic strategy a fall in yields prompted by the end of QT, a stated aim of the BoE, or a worsening economic environment, could put many schemes right back at square one.

Any return to deficit will need to be funded by the sponsoring companies, which in effect means management today borrowing from management in the future, with the risk put on the members themselves. Even today many companies with DB pensions are in financial distress – one in four companies with a DB scheme issued a profit warning in 2024.(4) Until there is complete security for members’ pensions, members are inextricably linked to the fate of their former firm.

The only purpose of a DB scheme is to pay their members’ pensions so, we polled 1,000 of them to find out their views. Perhaps unsurprisingly we found that security is extremely important to pension scheme members. 96% say certainty about the level of their pension over future years is “very important”, or “important.”

A sudden reversal of gilt yields, caused perhaps by an end to QT, or a reversion to QE, could put the pension security of millions of people in jeopardy.

The best way to protect against this is buyout where a pension scheme purchases an annuity policy that covers all of its liabilities. The insurer takes on responsibility for paying pensions and the scheme can be wound up, after which the members become policyholders of the insurance company.(5)

With the current pension scheme funding levels this is an ideal time to explore buyout. It guarantees pensioner

payments and removes pensions from company balance sheets. It also allows pension insurance companies such as PIC to invest at scale in infrastructure and housing delivering significant social value.

1 Professional Pensions, UK businesses pumped £200bn in pension contributions to avoid funding level drop, May 2021

2 NBER estimates between 44bps and 70 bps.

3 Pension Protection Fund, The Purple Book 2024

4 EY, Profit warnings from UK-listed companies with DB pension scheme reach four-year high, 11 February 2025

5 Pension Insurance Corporation (PIC), The Benefits of Buyout, What do defined benefit pension scheme members think about the risks to their pensions? Pension Risk Transfer Explained, June 2025

|