Sarah Coles, head of personal finance, Hargreaves Lansdown: “Some people will always live in fear that something catastrophic could be around the corner. But even those who aren’t part meerkat, constantly on the lookout for risks, might have been spooked by all the talk about the financial stress that could be on the horizon. The good news is that while there are some signs of weakness in the economy, unemployment is still low by historic standards, interest rates have fallen, and while economic growth is stagnating, this isn’t a recession. It means we don’t need to doom-prep for an imminent financial disaster. However, we can never know what lies ahead, so it's a good idea to make plans that will stand us in good stead if life takes a turn for the unexpected.

How much you need in theory

Most of the heavy lifting in your financial safety net will be done by your emergency savings. Financial advisers recommend working towards having enough cash to cover emergency spending for somewhere between three and six months while you’re working age – plus money for any planned expenses over the next five years. Once you retire, you should have cash to cover between one and three years’ worth.

The idea is that this is enough to cope with a run of expenses out of the blue, or to cover your costs if you lost earnings for a period. You don’t need to pay for everything – just keep things ticking over until life improves.

The first step is to consider how many months’ worth of essentials you need to cover. Where you fall on the spectrum of 3-6 months or 1-3 years will depend on your circumstances. If, for example, there are a number of people relying on your income, and you have had health problems in the past or your income is insecure, you’ll probably feel more comfortable holding more. Your considerations should also include how many earners there are in the family and the insurance cover you have in place. When you've retired, one key consideration is how much of your income is guaranteed.

There’s also a huge difference in what people consider essential. It means the second stage is going through your spending and isolating the things you can’t live without, and what they cost. This will show what you should be aiming for.

If you don’t have enough set aside, you can set up a monthly direct debit into a savings account. Even if it feels like a mountain to climb, you’ll be surprised how regular small steps will take you to your target over time. Even if it feels like you’ll never get to 3-6 months’ worth, you’ll be grateful for whatever you can put aside. The best place for your emergency fund is an easy access savings account or cash ISA. It’s worth checking out online banks and cash savings platforms, where you can usually find higher rates than the high street giants.

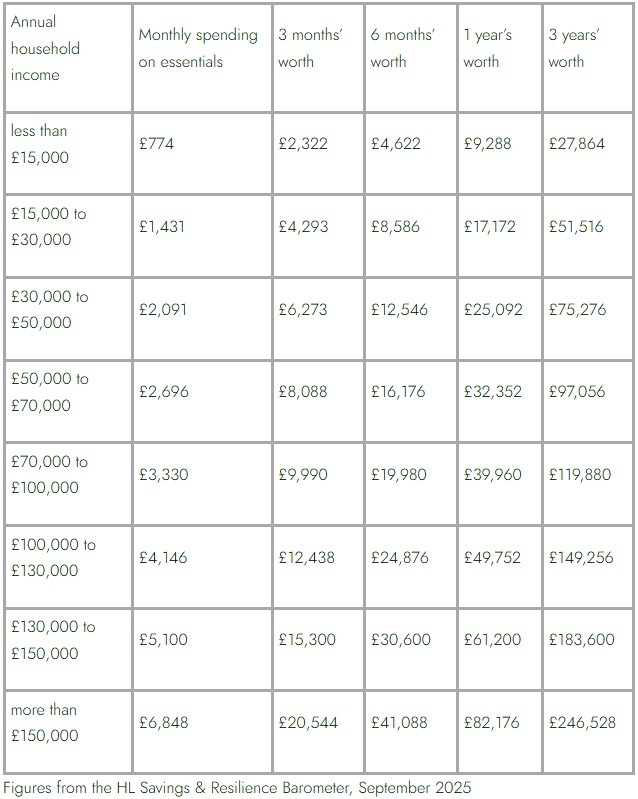

How much you might need by income bracket

For a rough idea of how much some people tend to need, the HL Savings & Resilience Barometer calculates how much households in different income brackets tend to spend on the essentials – which should give you a starting point.

What else?

Emergency savings are an essential part of preparing for difficult times, but they’re not the only vital step. It’s also worth considering your debt position. If you are carrying short-term expensive debt, then any period where you can’t keep up with repayments could have a major impact on your finances and your credit record. One sensible way to protect yourself from this is to pay these debts down wherever possible.

It’s also important to think about insurance cover. This includes life cover if the worst was to happen, but also cover if you are unable to work because of illness or injury. Critical illness cover will provide a lump sum if you’re diagnosed with certain specific illnesses – or suffer specific injuries. Income protection is more expensive, but will pay out a proportion of your income for a specific period, so could be a real lifeline.”

|