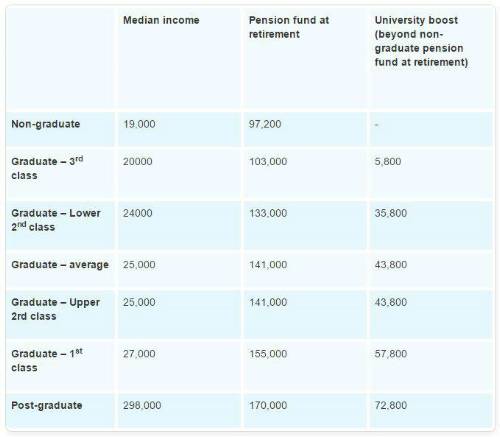

Analysis by Aviva suggests that going to university could boost your pension fund by £72,000 at retirement.

By the time the non-graduate and the graduate reach retirement, the difference in their pension funds could be over £43,000 – with the typical non-graduate amassing £97,200 by the age of retirement and the typical graduate amassing £141,000. This is based on the conservative assumption that both are automatically enrolled into a workplace pension at age 22; incomes rise with price inflation; and minimum employee and employer contributions are made until retirement.

The university boost to your retirement funds could be even greater depending on the classification of your degree. A first-class graduate could look forward to a boost of more than £57,000. If you have a post-graduate degree, the boost could be more than £72,000. A boost of £72,000 could add more than £3,500 to your annual retirement income for the rest of your life.

Commenting on the analysis, Alistair McQueen, Head of Savings & Retirement at Aviva said, “Much of today’s discussion is focused on the cost of going to university and the rising levels of student debt are an understandable concern. Indeed, Aviva’s own research[4] found that a typical graduate expects it will take at least 11 years to pay off their university debts.

“Today’s data reminds us there is a significant potential value associated with going to university. It suggests university provides a good return on your investment of time, money and effort. A university degree could boost your pension fund by more than £72,000 – enough to generate an extra £3,500 for every year in retirement.

“There are many factors to consider when deciding whether to go to university, and retirement may be the last thing on a student’s mind as they begin their working life. But the 500,000[5] who enter higher education this year are not blind to their needs in later life. Aviva’s research4 found that saving for retirement is within the top 4 financial priorities for the young, after property, family and buying a car. Understanding the full picture when you are young will help build a solid financial footing for later life.”

|