Laura Suter, Director of Personal Finance at AJ Bell, comments: “Labour have already played fast and loose with their commitment not to raise taxes for working people. They hiked national insurance last year but claimed it didn’t break the pledge as employers had to foot the bill. They also continued the freeze on income tax bands, started by the Conservatives, which amounted to a tax increase without explicitly hiking income tax. So it wouldn’t be a shock if the manifesto pledge was quietly ignored and income tax was hiked.

“The government is faced with the simple issue of having a fiscal hole to fill and needing to raise money to do so. With an estimated shortfall of £30 billion, it’s not going to be an easy gap to plug. While tinkering with other taxes may raise small amounts here and there, an increase to income tax raises a big chunk of money in one move – approximately £7bn by the Government’s own estimates. At the same time there aren’t the same pesky industry groups or lobbying firms that will voice opposition to the move, like we’ve seen with the changes to inheritance tax on farms.

“Make no mistake, a move that hits every income taxpayer in the UK is not going to go down well with the public, with a cost of just over £1 a day for those earning around £50,000. But it’s unlikely to lead to protests in the street and persistent headlines in the papers, like we’ve seen with farmers after last year’s changes to IHT.”

How much would a 1p rise in income tax cost?

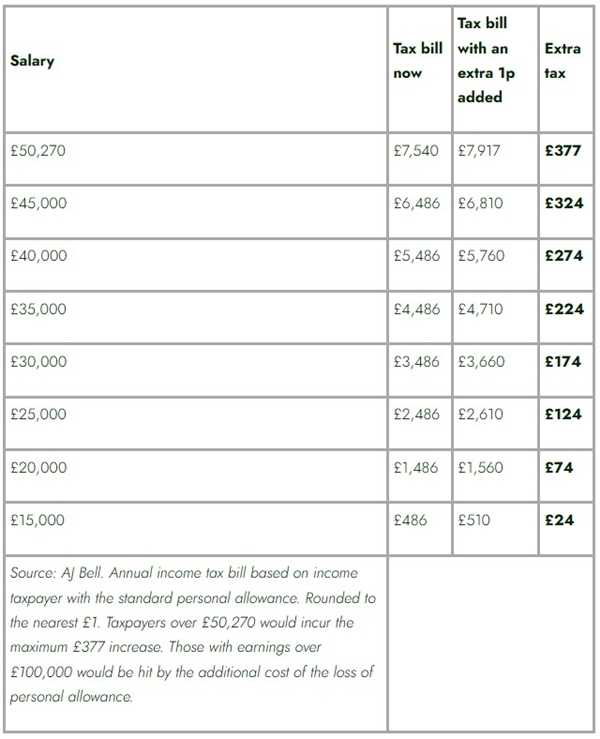

“If government wanted to change income tax, the most straightforward option would be to add 1p to the basic rate of tax, increasing it from 20% to 21%. That would cost taxpayers up to £377 a year in extra tax, with anyone earning £50,270 or more facing the maximum hit.

“A more nuclear option would be to add 1 percentage point onto all income tax rates, also taking the higher rate up to 41% and the additional rate to 46%. While it’s possible income tax rates could be hiked across the board, higher and additional rate taxpayers already account for a disproportionate share of the income tax take. What’s more, increasingly aggressive rates risk discouraging people from taking promotions and progressing their career. An increase to the basic rate is easier to position as a shared burden since it affects almost all workers, as well as pensioners and some savers.

“Probably more of a motivation for the government is that increasing the higher and additional rates of tax raises far less money than changing the basic rate. Based on HMRC figures increasing the basic rate to 21% would raise £6.9 billion in the next tax year and £23.4 billion over the next three years. In comparison, hiking the higher rate to 41% would raise £1.6 billion next year and increasing the additional rate to 46% would raise a relatively paltry £145 million in extra tax revenue.”

Are other options available?

“One option put forward by the Resolution Foundation is raising income tax but offsetting the impact on employees with an equivalent cut to national insurance.

“That would raise overall tax rates for pensioners, landlords, savers and perhaps those with dividend income too, while offsetting the impact on workers. Given the manifesto pledge focused on workers – a definition the government tied itself in knots trying to pin-down – the chancellor may be able to argue this policy raises taxes without breaking the spirit of the pre-election promise.

“It's also quite possible Reeves will extend the current freeze on tax thresholds beyond April 2028. This stealth tax, first initiated under the last government, has already heaped billions onto the nation’s income tax bills. Keeping it in place helps raise tax revenues without increasing the headline rate of taxation. In fact, it’s entirely possible we see a double-whammy of an increase in income tax rates and an extension to the threshold freeze.”

|