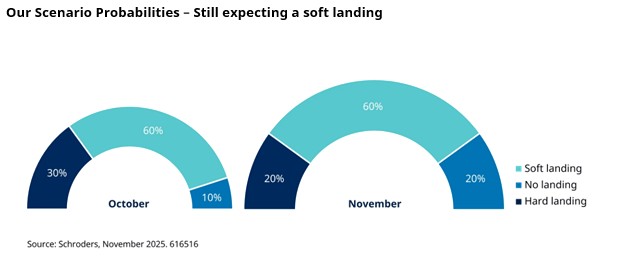

Given the lack of clarity, it’s no surprise that neither our scenario probabilities nor our views on global duration and major fixed income sub-asset classes have changed materially over the month.

A soft landing continues to warrant the highest probability (60%). However, we now have an equally weighted risk across a no landing and hard landing outcome, having previously been slightly skewed towards a hard landing. This change mainly reflects our expectation that US data - once released - will hold up in the near term.

Lots of noise, but little signal from recent US data

Aside from the market’s shift in expectations after October’s Federal Reserve meeting – when Chair Powell signalled that a December rate cut was far from guaranteed – US bond yields have seen little movement in recent weeks. This is not surprising given the lack of official US economic releases, but also the lack of directionality in what has been released.

Investors are keenly focused on the US labour market – and here current evidence regarding the short-term outlook continues to be both limited and mixed. Broadly speaking, we expect some stabilisation in job growth in coming months but timing this given the high level of near term uncertainty is challenging.

As we move into 2026, fiscal policy will support activity, but in the next month or two, there are some signs that the consumer will remain somewhat subdued. We’ve seen weakness in US auto sales for instance – where we think the end of Federal subsidies for electric vehicles is only part of the story for the softening demand.

The story in Europe remains largely unchanged

The macro backdrop in mainland Europe is little changed over the month. We struggle to get too excited about the near-term outlook for the European Central Bank, but expect a more dovish inflation narrative could emerge in early 2026, with downside risks to inflation.

Where does this leave us?

We expect government bond yields to track in relatively tight ranges until a clearer narrative emerges on how well - or not - the US economy has navigated the US government shutdown. As such we remain fairly neutral on interest rate risk overall.

Nevertheless, with US fiscal challenges still lingering and a large question mark over the legality of US tariffs, and therefore tariff revenues, we retain a steepening bias (positioned for shorter maturities to outperform longer maturities) across portfolios.

Within the eurozone, we’re less negative on semi-core markets - while France’s fiscal fragilities remain and have scope to resurface in 2026 - but for now look contained.

In corporate credit, our relative preference for front end exposure in both European and US investment grade (IG) credit still holds. US IG as a whole, however, remains unattractive in our view based on valuations, as does high yield in both the US and Europe.

|