By Alex White, Managing Director, Co-Head of ALM at Redington

One notch more complex, you could hold put options, options on the VI, or options on multiple underlyings together. A more complex hedge could involve a variance swap. This brings enormous convexity as the variance is the square of the volatility. For example, the VSTOXX Index (Euro equivalent of VIX) had a high and low of 12-46, while the VIX has ranged from 11-66. For illustration, had the peaks coincided, then a variance swap (long VIX short VSTOXX) would have been 23 units of variance OTM at the low, and 2240 units ITM at the high.

However, this effect could easily have been reversed for a European-driven crisis, so it’s more a bet than a hedge, perhaps pairing variance swaps with volatility options could be a good strategy , but certainly a complex one. Almost certainly, combining a few good ideas would be better than relying on a single one, as each is likely to fail in some possible scenarios.

What tail hedging strategies have in common, in general, is that they mostly lose a small amount of money, and occasionally jump in value. In that sense, they’re like the opposite of a corporate bond. The crucial difference is that, if they work, you get the money when you need it the most. A strategy that loses money can help a portfolio if it makes money at the right time. If you get an influx of cash when stocks are cheap, and you rebalance quickly, you can buy more units of equity. More mathematically, trimming the tails to make them less bad has an outsize impact on compounding.

To make this concrete, consider a two asset universe. We have the S&P500 from 1988, and we have a tail hedging strategy. This costs 1% pa, and pays 20% once for each time the market is down 35% from its high. So, if markets go from 100 to 60 to 90 to 50, it will only pay for the first fall. This is not an especially feasible asset, but it’s easy to model and makes a good example.

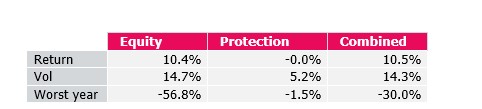

On its own, this asset would have lost 3bps pa (gross), with 5% volatility. For comparison, the S&P earned 10.4%, with 15% volatility. And yet, a combined product of both would have outperformed the S&P by 20bps pa.

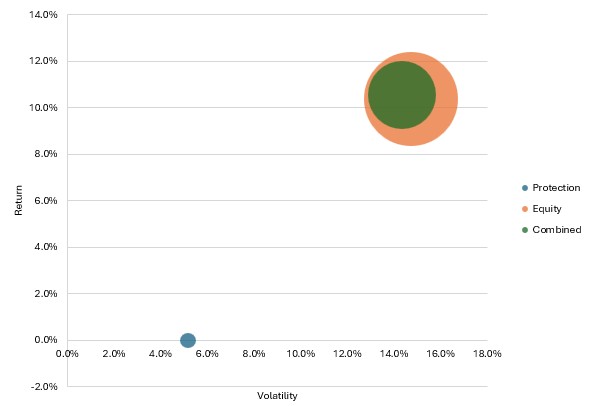

We can also see this on an efficient frontier. We show this as a bubble chart, where the bubble is the size of the worst 12m period experienced. Adding the tail hedges improves both the volatility and the returns, despite the protection strategy having negative returns.

Now this asset is not overly feasible, and it is somewhat cherry-picked (to have negative returns but increase overall returns). If it cost 3%, it would be a net drag on the combined portfolio. However, the key point is it will always have a more positive impact when rebalanced with equity than it will on its own. And that means tail hedging can actually increase returns (if the combined position is rebalanced quickly), even if the hedging position has a negative return on its own.

|