By Ben Stroud, Head of Insurance Transfers and Siobhan Lough, Senior Consultant from Hymans Robertson By Ben Stroud, Head of Insurance Transfers and Siobhan Lough, Senior Consultant from Hymans Robertson

This article highlights some of the key themes from the survey and draws attention to the demographic segments where insurers could do more to enable customers to achieve better financial outcomes.

Making ends meet

Financial Lives is an ongoing FCA initiative, part of which involves surveying a nationally representative group of UK consumers to provide long-term trend data on consumer behaviour and experience. As part of it's 2024 survey, the FCA surveyed almost 3,500 individuals from December 2023 and January 2024 with a particular focus on how the continuing increased cost of living is affecting the lives of adults across the UK.

Over three quarters of those surveyed had made changes to their day-to-day spending over the past year, to manage their finances as a direct impact of rising prices. Some of these changes include spending less on food shopping and heating homes, working extra hours or taking on second jobs to make ends meet. Worryingly, more than 10% of individuals also reported missing meals as they couldn’t afford them, and this statistic increased to over one-third when considering those who reported as either ‘not coping financially’ or ‘finding it difficult to cope’.

Protection market

Almost 20% of UK adults who held an insurance or protection policy have cancelled these policies in the last 12-months to save money or because they couldn’t afford the premiums. General insurance has taken a greater hit than life insurance, with pet and gadget insurance being the most cancelled policies.

Whilst others haven’t cancelled policies, nearly 10% have reduced or are considering reducing the level of cover their current policies provide. This percentage varies by household income and, unsurprisingly, it’s lower income households that are feeling the pinch, with more than twice as many of those in the lowest income category (<£15k) reducing or considering reducing their cover than those in the top income category (>£100k). This is concerning given that lower income households are likely to be less financially resilient and therefore have the most to gain should they need to claim on an insurance policy.

General savings and investments

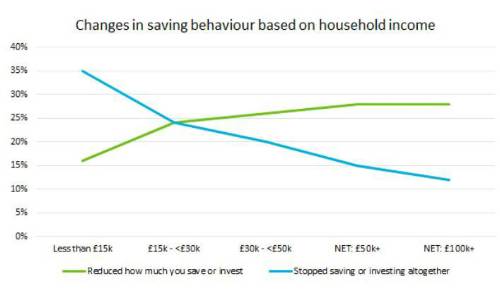

When looking at non-pension savings, we see higher proportions of adults reporting that they have stopped saving or investing, and/or are using current savings and investments to cover day-to-day expenses, than the number making changes to insurance policies. 45% of adults said that they had stopped saving or investing or reduced how much they had saved or invested in the last 12-months.

As we can see in the above chart, more people at lower incomes are stopping saving or investing altogether, rather than reducing the amounts that they save. At the other end of the earnings-scale, as income increases, fewer people have stopped saving or investing. However, it’s obvious that even high-income households are feeling the pressure, with just under one-third of those with a household income over £50k each year reporting that they have reduced the amount they saved or invested over the past year.

Pension Saving

While 45% of adults have reduced or stopped their savings and investments, it was encouraging to see that only a minority of these (6%) had stopped contributing to their pension or reduced their contributions in the last 12-months. This suggests consumers are prioritising the tax-efficient (and employer contribution funded) pension savings taken up through auto-enrolment, continuing to plan for funding their future lifestyle. However, this is not level across society, with double (12%) the proportion of individuals in ethnic minority groups or lower socioeconomic groups having reduced their pension contributions or stopped contributing at all. A related issue that is not addressed through the survey is whether individuals’ current levels of contributions will be sufficient to provide their desired level of income in retirement. Those contributing to their pensions through auto-enrolment may find themselves unable to immediately restart their contributions. This research suggests that there is more that can be done to educate customers on the importance of long-term savings and equip them with innovative products that meet both their saving capabilities and needs.

Renters vs homeowners

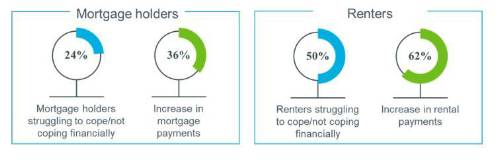

The Financial Lives survey found that adults who were finding it difficult to cope or not coping financially would consider rent and mortgage payments as a high priority over other bills. 1-in-6 adults cut back on essentials such as food, basic household items and heating to be able to pay their mortgage or rent – this was true for almost one-fifth of all mortgage holders and over a third of all renters.

This shows that fewer mortgage holders struggled compared to renters, which is perhaps unsurprising given that mortgage holders generally have higher levels of wealth, so they are likely to be more financially resilient. There is however, still a significant proportion, almost one-quarter, of mortgage holders who are finding it difficult to cope or are not coping financially. Rising interest rates have been well documented in the press and the impact of this is clear in the data. With more than 1-in-3 mortgage holders seeing an increase in their mortgage repayments in the last 12 months. The picture is starker for renters, where roughly 2-in-3 saw an increase in their monthly rent over the 12-month period.

Renters represent a growing proportion of the population, not least because increasing house prices are making homeownership unaffordable to the younger generations, and results show that half of the rental population are finding it difficult to cope or not coping financially. A survey carried out by Hymans Robertson in 2019 found that over 1-in-5 renters were most concerned with landlords increasing rent to a level they couldn’t afford. In the current economic climate, this proportion is likely to be higher. The additional hardship renters face in terms of their ability to save compared with mortgage holders is obvious here. Coupled with the well documented protection gap when it comes to renters’ insurance coverage, it is clear that renters represent an underserved section of the market.

Consumer Duty

Despite the high numbers of adults experiencing financial difficulties over the last 12 months, on affluent consumers tending to be more financially literate or more likely to seek out, 5% of those experiencing financial difficulties have sought support from lenders or charities. Still, almost half of those who accessed support were in a better position for it. This shows the value of advice and support, something that both of the Consumer Support and Consumer Understanding outcomes of the FCA’s Consumer Duty are intended to improve.

With so many individuals struggling financially, there is an opportunity for firms to do more to reach out and support customers. A one-size-fits-all approach will not work here. Research commissioned by Hymans Robertson in 2022 found that those with differing levels of wealth require differing types and levels of support, with more affluent consumers tending to be more financially literate or more likely to seek out, and afford, advice.

Our research showed that only half of those with Defined Contribution pension savings up to £100k had ever received advice from an Independent Financial Advisor (IFA), compared to three-quarters of those with pensions over £250k. Half of people with the smallest pots cited “cost” as the reason they didn’t plan to take paid financial advice, whereas those with larger pots cited they did not need financial advice and already understood their retirement options. This represents a striking social inequality issue. We hope that the FCA’s ongoing review of the Advice Guidance Boundary will encourage or enable firms to better serve the needs of under-represented segments of the market.

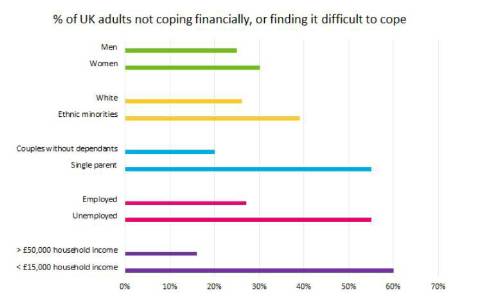

Financial Lives analysis is broken down into different demographic segments and it’s very clear that each of these segments has differing needs, as shown in the graph below.

The FCA has said that they plan to use the results of their Financial Lives surveys to assess and monitor how effectively firms are meeting the requirements of the Consumer Duty. A significant part of the Duty is the need to identify the target market when designing products and services. This means that when it comes to the consumer buying a product or service, their individual circumstances should be understood, and they should be presented with a range of products that have been designed to meet their needs. Those individuals who are not coping or struggling to cope financially could be more likely to find themselves in vulnerable circumstances. It is important that we are able to identify these customers, and breaking down data into different demographic segments, as above, could be a helpful aid in flagging those in potentially vulnerable circumstances.

Conclusion

The FCA’s Financial Lives Survey 2024 shows that UK adults are continuing to struggle with the increased cost of living. This is true more so for certain demographic segments than others, and this analysis helps to highlight the groups where more could be done to reach and support customers to achieve better outcomes. Practices embedded through the Consumer Duty should help to ensure customers are presented with products suitable to their needs and that those in vulnerable circumstances are treated appropriately.

We encourage firms to engage with the results of the Financial Lives survey and assess how they map onto the firms’ offerings and customer base. While not all firms will have seen large shifts in customer behaviour, consumers may still be under greater financial strain due to the ‘cost of living crisis’. More customers may be financially vulnerable and suffering in silence than ever before. The timing of these results provides a good opportunity to reflect on the options and support offered at this time and how they best serve the needs of customers.

|