|

|

As of 31 December 2024, FTSE350 DB pension scheme sponsors could unlock £47bn of economic value via surplus refunds, according to DB End Gauge analysis from Barnett Waddingham (BW). |

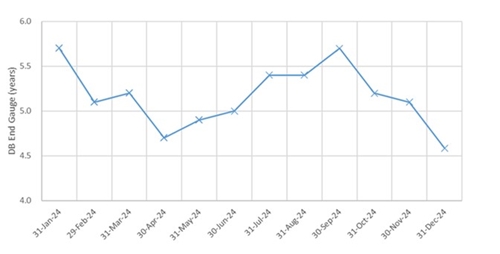

• As of 31 December 2024, Barnett Waddingham’s DB End Gauge index was 4.6 years to buyout.

• The estimated aggregate surplus on a low dependency basis is £63bn (vs £60bn in November). If refunded in full, this would result in around £47bn being paid to the FTSE350 companies and £16bn being paid to HMRC in tax. As of 31 December 2024, the estimated low dependency surplus in the FTSE350 schemes was £63bn. The aggregate surplus is estimated to have increased in the last half of last year, from £45bn at 31 May 2024 to £63bn at 31 December 2024, primarily due to the increase in bond yields reducing DB scheme liability values. Lewys Curteis, Principal at Barnett Waddingham says: “Our latest DB End Gauge analysis illustrates the robust position of the UK’s FTSE350 DB pension schemes, with the increase in bond yields towards the end of the year further strengthening funding levels. “While the recent movements in bond markets will generally have been positive for DB scheme funding positions, companies and trustees should remain vigilant to the impact of this volatility. Action may be needed to ensure investment strategies remain appropriate and opportunities to reduce risk are captured. “Depending on the extent of any funding level gain, sponsors may be in a position to renegotiate cash contributions or accelerate plans for an insurance or superfund transaction.”  You can follow the index here. Methodology DB End Gauge is calculated using publicly available data collected from the annual accounts of the FTSE 350 companies. As such, it covers around 150 companies with DB pension arrangements and is calculated as the average of the estimated time to reach buyout funding for each scheme. |

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.