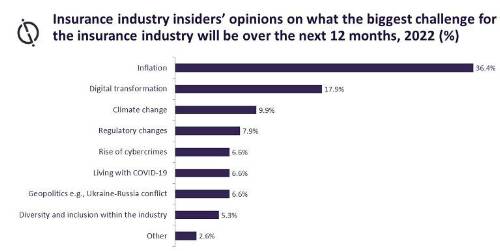

According to a GlobalData poll over a third of insurance industry insiders cited inflation as the standout challenge for 2023. It was significantly ahead of other key themes such as digitalization, climate change, regulation, COVID-19, cybercrime, and geopolitics.

Ben Carey-Evans, Senior Insurance Analyst at GlobalData, comments: “Inflation poses such a significant threat to insurers as they face a double-edged sword. Insurers will face inflationary pressure themselves in terms of the cost of running their business and claims costs will rise as a result of supplies and work becoming more expensive. However, while insurers would usually pass on higher claims costs to consumers in the form of higher premiums, individuals in the UK have less disposable income than ever, with the cost of living soaring and wages remaining stagnant. This will make it hard for insurers to push through premium rate increases while not losing customers and seeing penetration rates fall.”

GlobalData’s 2022 UK Insurance Consumer Survey found that across personal lines products, consumers are conducting more research at renewal but not necessarily switching more. This is likely due to Financial Conduct Authority reforms preventing insurers from offering new customers preferential rates, as well as insurers struggling to offer cheaper premiums while their own costs are rising.

This means insurers that offer some point of differentiation are likely to pick up more new business, as consumers are increasingly looking for any added value they can find. This could include increased flexibility such as the ability to switch cover on and off, only paying for exactly what they use (e.g. pay-per-mile), or even payment breaks (as was seen during the COVID-19 pandemic).

Carey-Evans concludes: “Overall, it will be difficult for insurers to make a profit from premiums and maintain penetration rates in the short term. It may be wise to take a long-term approach to try and keep existing customers happy and gain new ones by offering consumers more flexibility as financial difficulties increase at the start of 2023.”

|