Key Takeaways

• In 2025 so far, the insurance market continued to soften across most lines by an average of minus 11-20 percent, although motor is an outlier with rates still increasing marginally.

• Insurance capacity is ample, and there is more flexibility in underwriting. Limits have increased, while deductibles have remained flat, and coverage broadened as insurers chose to compete on policy terms.

• To get the best results, engaging early at renewal with brokers and insurers remains important, with the opportunity to broaden cover, restructure, and take advantage of the market conditions.

• Beyond the market, there is broader uncertainty and volatility globally, both from specific macroeconomic challenges such as trade tariffs and the wider geopolitical challenges. Insurance buyers should be mindful that these factors could impact the insurance industry in the coming months.

“We see no reason why the current market conditions will not continue, certainly for the short term, and even accelerate and soften further in some areas as we go into the second half of this year”, Josh Webb – Head of London Broking, Commercial Risk, Aon, United Kingdom.

UK Construction

Insurance sees rates reduce and more capacity in 2025

Current Conditions

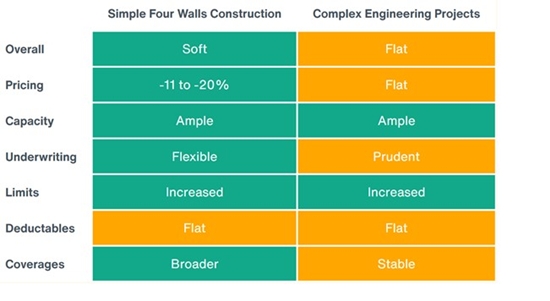

• In the construction ‘all-risks’ market (property-based cover, not liability), rates are generally trending downwards by minus 20 percent for traditional four-walls construction, with ample capacity from existing carriers, as well as from new markets.

• For complex engineering projects, pricing is flat, and underwriters are being more prudent than they would be for traditional construction risks.

Outlook

• The new capacity coming into the market will be available for complex risks which could provide more competitive conditions.

• Risk management continues to be a key element for insurer consideration and certain areas need to be well covered, such as having a water risk management process in place to get the right level of coverage.

• The advice for renewal remains to engage early and have strong relationships with key partner insurers. In instances of major claims or a series of similar losses, ensure it can be shown that lessons have been learned and that working practices have been improved, to ensure similar incidents cannot happen again.

“There is a lot more flexibility from carriers around what they're prepared to do, whether it's looking at an extension of limits, or whether it's around deductibles”, Simon Simpson – Managing Director, Construction & Infrastructure, Commercial Risk, Aon UK.

Professional Indemnity Insurance

Rate relief and broader coverage

Current Conditions

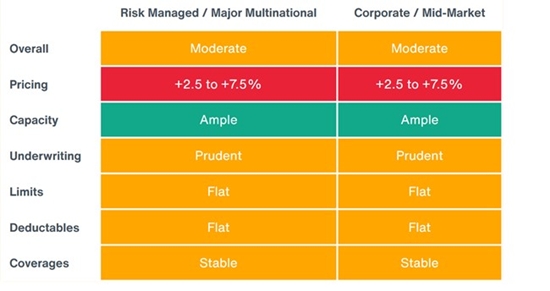

• A general softening to the professional indemnity (PI) market has continued in 2025 with rates falling from minus 5 -15 percent for major multinationals and from minus 10 - 20 percent for corporate/mid-market, driven by increased insurer competition.

• With the increase in available capacity, insurers are offering larger shares of risks and are more agile to win new business.

• For insureds, these favourable market conditions have led to enhanced terms with an expanding breadth of coverage and fewer exclusions.

Outlook

• Throughout 2025, the PI market in London is likely to remain competitive, with insurers actively pursuing business.

• All insurers are looking to see proactive risk management from their insureds, so it is important to be able to demonstrate and articulate that the risk management procedures in place are sufficient. Meetings with existing and any potential new markets can be a great way to get that across.

“One of the most important aspects at renewal is to get the right balance between the cost, the cover, and security to deliver long-term value, rather than just focusing on potential short-term savings”, Mike Pearson – Head of Financial Lines, Commercial Risk, Aon UK.

Motor Fleet Insurance

Rate increases slow as competition grows

Current Conditions

• Motor fleet rates continued to rise in Q1 2025 but at a slower pace than seen earlier in the year.

• Claims inflation remains the major challenge, with rising costs in vehicle repairs, parts, and labour costs.

• That said, there are signs that claims inflation is starting to moderate; this view is balanced with the wider geopolitical issues that may continue to impact supply chains.

Outlook

• Increased competition is likely to continue into the next quarter.

• Well risk-managed fleets and those that have not been to market in recent years may benefit from better renewal outcomes, with expiring rates and savings still achievable for certain cases. Poor performing fleets and those in challenging sectors may continue to see more challenging conditions.

• Insurers are showing signs of widening their appetites and quoting risks and certain trades that were previously declined.

• A successful renewal continues to depend on the quality of risk management information and how this is used to influence and reduce claims frequency, along with a sufficient lead in time to allow adequate analysis of the claims and subsequent negotiation.

“Insurers are fighting harder to retain clients compared to 12 months ago, focusing on both retaining their held book of business while trying to continue to meet their growth plans”, Adam Richardson – Head of Motor, Commercial Risk, Aon UK.

Liability Insurance in the UK

Rate reductions and insurer flexibility

Current Conditions

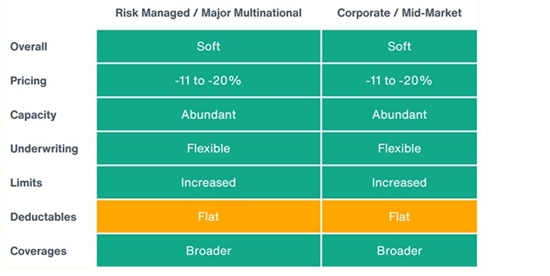

• Soft market conditions in liability have continued with rate decreases of between minus 11 - 20 percent on average for risk-managed/major multinationals and between minus 11 - 25 percent for corporate and mid-market sized businesses.

• Insurers are actively looking for top-line growth, which has resulted in those accounts achieving considerable rate reductions, with incumbent insurers willing to reduce rates to retain accounts.

• Offers of long-term agreements are now common, and insurers are working hard to differentiate themselves, whether from a superior multinational offering or an enhanced service proposal.

• Insurer concern around US exposure remains, particularly around US Auto.

Outlook

• For the rest of 2025 and into 2026, the soft market environment is likely to remain the same, with insurers focused on meeting their targets, partnered with a widening of risk appetite.

• Insureds planning for renewal should engage early. It’s key that businesses respond to all insurer questions, as, despite the soft market, insurers still need to ensure that their underwriting guidelines and treaty requirements have been met; timely and comprehensive response to queries allows this.

“Soft market conditions continue at pace for the foreseeable future. We are encouraging our clients to take advantage and lock in where possible”, Gabriel Field – Head of Casualty, Commercial Risk, Aon UK.

Property Insurance

Market softens with competitive pricing and broader terms

Current Conditions

• Soft conditions have continued in property with pricing down from between minus 11-20 percent, and rates are heading towards pre-hard market conditions in some cases.

• The market has plenty of capacity, which is not only leading to price reductions but also a slight broadening of coverage. Long-term agreements, cancellation and rewrite options are common.

• Good market management is critical. Insureds should carefully consider the best terms and conditions against long-term insurer partnerships.

Outlook

• There are lots of growth targets out there for insurers and quite possibly not the same amount of business to satisfy all of them, which means the competitive environment is likely to continue through the second half of the year.

• Some unknowns relate to the global tariff landscape, which could impact supply chains, indemnity periods, and insurer investment returns.

• For renewal, pursuing the lowest price with specific insurers might not necessarily support some of the longer-term objectives in place with key partners; it's about insureds trying to find that balance between the two and working to future-proof their programme.

• As ever, early engagement with insurers and quality renewal submissions with updated values is a must.

“If any of your covers were removed or reduced during the hard market, think about requesting them back. It is a highly competitive environment, and insurers are looking to try to differentiate themselves with the cover they offer”, Helen Bailey – Broking Director, Property, Commercial Risk, Aon UK.

Summary: Healthy insurer results driving improved conditions for buyers

• Insurers have reported some strong full-year results over the last few months, which is underpinning many of the changes in market conditions seen, particularly around pricing and increased capacity.

• Tracking insurers’ combined ratios over the last decade illustrates why the market is moving the way it is.

• From 2017 to 2020, there was less profitability in the insurance sector, with a sustained period of natural catastrophe losses hitting the whole industry.

• After an upward spike in 2020, there has been a general trend downwards in combined ratios to the point where, in terms of the latest results just released, many key insurers have reported underwriting profit.

• Emerging insurer growth plans are likely to further increase competition and supply across the market, providing insureds with additional opportunities, at least in the short term.

|