Investors are increasingly turning to active management to strengthen portfolio resilience and capture specific investment opportunities amid mounting economic uncertainty and market volatility, Schroders’ flagship Global Investor Insights Survey (GIIS) published today has found.

The survey, which spans nearly 1000 institutional investors and wealth managers globally encompassing US $67 trillion in assets, revealed that four in five investors (80%) are somewhat or significantly more likely to increase their use of actively managed investment strategies in the year ahead.

These findings follow significant market volatility earlier this year, largely triggered by the US Government’s decision to introduce wide-ranging trade tariffs.

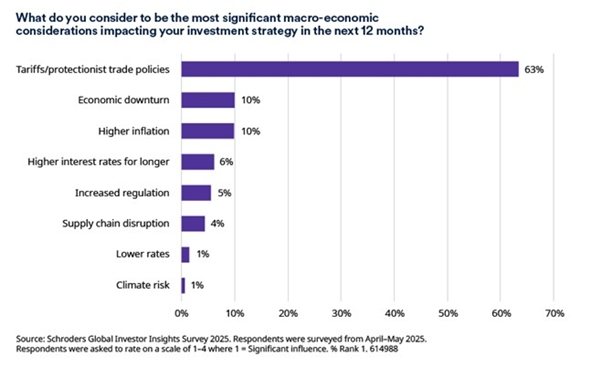

These tariffs were selected by nearly two-thirds of respondents (63%) as the biggest macroeconomic concern - more than six times the next highest perceived risk. This trade uncertainty is likely to have fuelled investors’ strong focus on 'portfolio resilience' over the next 18 months – which was the overwhelming top priority for portfolios, having been selected by more than half of all surveyed (55%).

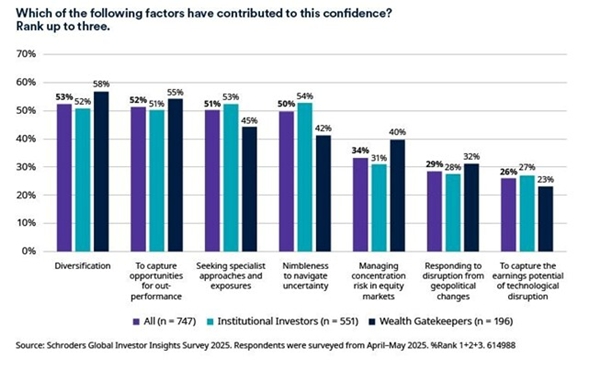

In fact, of the investors who prioritised portfolio resilience, a telling 82% said they are increasingly looking to harness active management. This was driven by a recognition that capturing investment opportunities (52%) and building portfolio resilience (48%) were the top attributes investors sought from their active fund managers.

Johanna Kyrklund, Group Chief Investment Officer at Schroders, said: “Active management is indispensable amid today’s fragmented markets. With four in five investors set to increase their allocation to actively managed strategies this year, it’s clear they value a selective and adaptable approach. “The wider backdrop is that financial markets are still adjusting back to structurally higher interest rates, made painful in many cases by high levels of debt. This is raising questions about future market trends and the value of passive approaches in a period of greater uncertainty.

“Resilience now tops the investment agenda, as the rising tide no longer lifts all boats. In this environment, active strategies provide the control investors need to manage complexity, create portfolio resilience and seize opportunities.”

The hunt for return opportunities is crucial during market volatility

Investors are actively seeking selective opportunities to generate returns through exposure to both public and private markets. Public equities (46%) and private equity (45%) have emerged as the preferred asset classes for return generation in the current environment. Notably, more than half of investors (51%) who believe public equities will deliver strong returns, believe global equity allocations will deliver the strongest performance. This shift underscores a growing conviction in reducing concentration risk and diversifying away from US mega caps, as 74% identified the S&P 500 as the index giving investors the greatest cause for concern about market concentration. Of the investors focused on public equities, 53% favour active strategies to maximise return potential – notably outweighing passive approaches (10%).

In private equity, small-to-mid cap buyouts are seen as compelling by 65% of investors, reflecting a pivot towards high-conviction investments with transformative growth potential and more likely to be insulated from global trade tensions.

The new income toolkit

Income generation is also evolving from a traditional fixed income allocation to multi-channel, risk-adjusted sources encompassing traditional bonds, corporate debt and asset classes within private debt and credit alternatives (PDCA). PDCA was the most attractive allocation option for global investors looking to generate income over the next 12 months, selected by 44% of investors, followed by high yielding equities (41%) and active public corporate bonds (33%).

The rise of alternative income sources is striking. Of the investors who identified PDCA as one of their top three income generators for the year ahead, infrastructure debt and securitised products were popular alternatives to direct lending, with 63% and 60% of investors respectively ranking them as a top three asset class for risk-adjusted income.

Amongst wealth managers who selected PDCA, nearly two-thirds ranked securitised products as the best opportunity for risk-adjusted returns (64%), followed by infrastructure debt (60%) and then direct lending (56%). This compares to institutional investors who view direct lending as the best opportunity (73%), followed by infrastructure debt (64%) and securitised products (58%).

Johanna Kyrklund added: "Investors are increasingly focused on resilience. They are seeking strategic returns through diversified global equities and specialist, conviction private equity. Meanwhile their search for income is evolving, with greater emphasis on multi-channel, risk-adjusted sources like infrastructure debt and securitised credit. In this context, it is clear why investors are turning to active management and a blend of public and private markets.”

To read the full report, please click here.

|