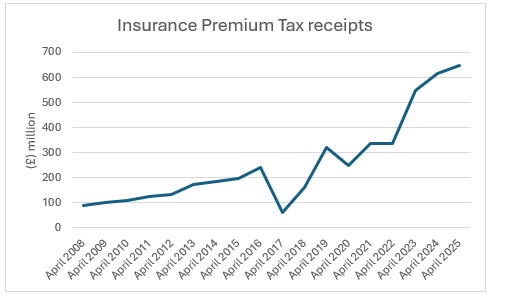

It marks a £33 million or 5% increase from the same month last year (April 2024), which initiated a record year of receipts - totalling at £8.88 billion (2024/25),and exceeding the 2023/24 full year total of £8.15 billion by £737 million or 9%.

Receipts in April 2023 stood at £548 million – pointing to a £100 million or 18% increase in just two years.

A decade prior, IPT receipts in the first month of the financial year stood at £195 million, £453 billion or 232% fewer than this month’s level, emphasising the significant growth in IPT revenue for the Treasury.

Cara Spinks, Head of Life & Health at Broadstone, commented: "IPT receipts for April 2025 have got the 2025/26 financial year off to a robust start, with levels already £33 million higher than the same period last year. After last year’s record £8.88 billion in IPT receipts, today’s data for April continues to reinforce IPT as a healthy revenue source for Treasury, thanks to continued growth in premiums across a range of insurance products.

“Growing demand for independent health insurance products has been one of the drivers for increased premiums and tax receipts. Over the last few years, we have not only seen an uptick in individuals opting for independent healthcare options, but businesses are increasingly investing in a variety of healthcare and wellbeing strategies to combat the rise in economic inactivity caused by chronic illness.

“Independent health insurance products, such as health cash plans, offer significant preventative healthcare benefits and we continue to urge the Government to consider removing or reducing the rate of tax charged to consumers on these products in order to support the general health and wellbeing of the UK workforce.”

HMRC tax receipts and National Insurance contributions for the UK - GOV.UK

|