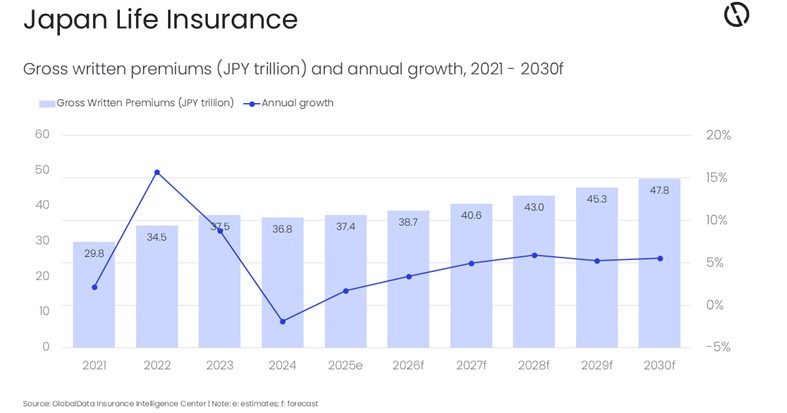

GlobalData’s Global Insurance Database indicates that the Japanese life insurance market is estimated to grow modestly by 1.7% in 2025, then pick up to 3.4% in 2026, supported by higher credited yields on new life policies, ongoing capital optimization (including reinsurance), and rapid digital distribution gains.

Katam Prasanth, Insurance Analyst at GlobalData, comments: "The 2026 inflection follows a 2024 contraction, signaling a stabilizing operating environment. Stronger sales of yen-denominated life policies have offset weakness in foreign-currency products, supporting topline stability into 2025 and establishing a stronger base for 2026."

The Ministry of Finance raised Japanese government bond (JGB) yields, with the maximum 40-year JGB interest rate rising from 3.34% in January 2025 to 3.56% as of November 25, 2025, to partially fund a JPY21.3 trillion ($135 billion) economic package. Life insurers have responded to this shift in yields—combined with decreased Bank of Japan bond purchases—by reducing domestic equity exposure and pursuing higher-yielding fixed-income investments, while balancing solvency and liquidity risks.

Katam adds: "In an effort to avoid mark-to-market losses on JGBs, some carriers have turned to hold-to-maturity accounting for portions of their JGB holdings—sacrificing near-term flexibility in favor of portfolio stability. These factors supported insurers in offering policies with more attractive interest rates, boosting demand."

Capital management and reinsurance are emerging as focal points. In March 2025, the Financial Services Agency stepped up oversight of offshore life reinsurance arrangements, especially those involving Bermuda-based structures, as insurers increasingly use cessions to improve capital efficiency amid changing regulatory standards.

Demographic trends will remain a durable tailwind for growth of Japan’s life insurance market during 2026–30. Japan’s aging cohort of 65 and above is expected to reach 32.3% by 2035, as per GlobalData’s Macroeconomic Database, raising the old-age dependency ratio to 53.1% (from 50% in 2023). Amid persistently low and falling birth rates, this remains a challenging situation. However, demand for protection, annuities, and health riders remains structurally strong, even as product preferences evolve. Studies of retirement readiness point to significant protection and savings gaps, creating opportunities for life insurers to expand coverage and develop income solutions for an aging population.

Katam continues: "Regulatory and policy changes will also shape growth strategies. Japan intends to enforce stricter rules linking foreign residents’ residency status with records for health insurance and pension payments, with full implementation expected by June 2027. This is expected to improve compliance and potentially influence participation in third-sector health and related policy riders within life insurance portfolios."

Additionally, leading insurers and venture-backed Insurtech are deploying digital tools and artificial intelligence (AI) to enhance underwriting accuracy, policy servicing, and claims processing. Digitalization also extends to distribution through embedded insurance, personalized service, and digital alliances, with brokerage consolidation expected to reduce acquisition costs and scale reach.

Katam concludes: "Looking forward, Japan’s life insurance sector growth is expected to stabilize over the next five years. While investment volatility and regulatory scrutiny pose challenges, the sector’s profitability, capital strength, and innovation initiatives should enable life insurers in Japan to sustain growth, deepen coverage, and narrow protection and retirement income gaps."

|