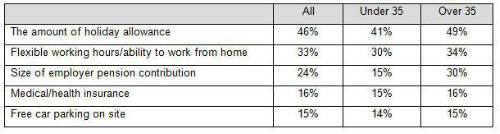

Holiday allowance (46%) and flexible working hours (33%) are seen as more desirable than pension contributions (24%) by UK employees

Under-35s value free on-site car parking (14%) as much as health insurance (15%) or pension contributions from employers (15%)

Over-35s (30%) are twice as likely to prioritise pension contributions compared to under-35s (15%)

When asked about the most attractive perks when looking for a new job, aside from salary, pensions fall into third place.

This is true for all age groups, although a higher percentage of over-35s see the value of pension contributions (30%, compared with just 15% of under-35s). Other desirable benefits across all ages include health insurance (16%) and free car parking on site (15%).

Younger workers prioritise immediate benefits over higher pension contributions

Younger workers prioritise immediate benefits over higher pension contributions

When presented with various benefit package options, workers under the age of 35 are more likely to opt for lower pension contributions in return for more immediate perks.

More than two in five (42%) under-35s would choose a benefits package including employer pension contributions of 4% of salary plus subsidised refreshments, gym membership and travel. Only 18% would opt for a package with double the amount of pension contributions (8%) but no other perks.

However, the opposite is true of older workers, with 48% of over-35s willing to sacrifice more immediate gratification to receive an 8% employer pension contribution.

Alistair McQueen, Head of Savings and Retirement at Aviva, comments: “The findings provide a sober reminder that our work is far from done when it comes to helping people take full advantage of workplace pensions and save enough to be comfortable when they retire. While other workplace perks are important, pension prospects should be right up there with promotion opportunities when looking for a new job.

“As hundreds of thousands of employees start their auto-enrolment journey this year, more must be done to help employees appreciate the importance of saving for their future and the value of a pension in doing so.”

|