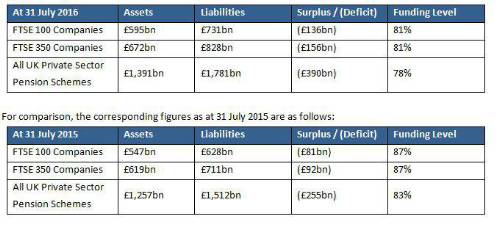

As at 31 July 2016, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “Pension scheme deficits have once again soared to record levels, increasing by over £135 billion in the last 12 months to £390 billion at the end of July. Markets may have recovered, following their initial dive, in the aftermath of the Brexit vote but conditions remain challenging for pension schemes. With hints of a rate cut on 4th August, at the next Bank of England’s meeting, it looks increasingly likely that record low rates are here to stay.

“Many pension schemes have already taken steps to match assets to liabilities, in an effort to protect themselves against adverse movements in bond yields. This has either been through significant increases in bond holdings or through the use of more sophisticated Liability Driven Investment (LDI) strategies, often using derivatives to improve protection. In today’s environment pension schemes cannot continue to follow the same strategies that have been used for the last 10 years.

“For those pension schemes that have little or no protection against movements in bond yields, the big question is whether they want to increase interest rate protection now that rates have fallen further to record lows. Instinctively, it will be difficult for trustees and companies to hedge interest rates at current levels when they have so far held off doing so in the hope of an interest rate rise – and have seen pension deficits increase as a result. By continuing a policy of not hedging interest rates, companies and trustees are effectively taking a large bet against the markets.

“In addition to this, there is also mounting pressure on the Pensions Regulator and pension scheme trustees to ensure sponsoring companies are using all of the levers available to them to reduce pension shortfalls. Companies with actuarial valuations this year will be hardest hit and trustees will likely have little option but to demand significant increases in cash funding from companies.”

|