By Fiona Tait, Technical Director, Intelligent Pensions

Equally irritating, and of much greater importance, are the restrictions that will remain even after the much-hailed abolition of the LTA.

Good news for income, not so good for lump sums

It seems that rather than total abolition, the relaxation applies to income withdrawals and not lump sum benefits. Pension income above the previous LTA will still be subject to income tax, however there will be no additional 25% tax charge on the excess.

The treatment of Pension Commencement Lump Sums (PCLS) is effectively unchanged (more later) and so individuals using their pension to provide retirement income will undoubtedly be better off. Not only will they ‘avoid’ the additional tax charge, but they will be able to save further amounts, so long as they are prepared to take the proceeds in the form of an income. This fits with the stated aim of abolishing the LTA to encourage well-qualified (i.e. well-paid and well-pensioned) individuals over 50 back to work after the pandemic.

In contrast, lump sum benefits will continue to be tested against a ‘threshold’ which is as yet unnamed, but happens to be equal to the current value of the LTA (no doubt they will get round to applying a suitable acronym in due course). Moreover, there is a sneaky little paragraph which could bring some previously tax-free lump sum death benefits into the taxable regime.

PCLS and other lump sums

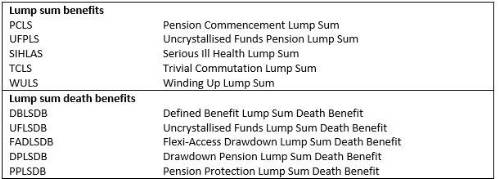

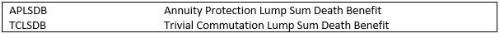

The ‘new’ threshold will apply to PCLS, along with an impressive array of other lump sum benefits which account for 12 of the aforementioned acronyms, feel free to test yourself against the table and see how many you can name without peeking:

Under this test PCLS will continue to be limited to 25% of the current LTA amount of £268,275, unless existing protections apply.

That’s right, because the LTA threshold is being retained, so are the existing protections. This may be good news for those individuals lucky enough to benefit from them, but it is very bad news for pension schemes and administrators who were looking forward to the loss of the 7 more acronyms and the record keeping necessary to identify Primary Protections (PP), Enhanced Protections (EP), Fixed Protections (FP), Fixed Protection 2014 (FP14), Individual Protection 2014 (IP14), Fixed Protection 2016 (FP16) and Individual Protection (IP16). And they say it’s the industry who makes things complicated!

The other lump sum benefits are not limited however any excess amounts will be taxed at the recipient’s marginal rate. This does mean that some of the applicable charges may be lower than the 55% that would previously have applied to a lump sum withdrawal, however those likely to face a charge are also those likely to be paying higher and additional rates of tax even before the excess pension is added.

For those wondering how a trivial commutation lump sum could possibly exceed a threshold of £1,073,100, the answer is of course that the threshold is applicable to each individual, rather than per scheme, or per benefit. All lump sum pension benefits, including lump sum death benefits, which are paid to a single individual from any registered pension arrangements will be added together and tested against the threshold.

Death before age 75

The financial press has been quick to pick up on a key paragraph in the policy paper published on the 18th of July which states that in relation to lump sum death benefits on death before 75:

"Individuals will still be able to receive the benefits … but the values will no longer be excluded from marginal rate income tax under [the Income Tax (Earnings and Pensions) Act 2003], with effect from 6 April 2024".

This has led to concerns that the full amount of these death benefits could become taxable, even if the benefits are taken as an income. The draft legislation does not however reflect this and seems intended to only catch lump sum payments which, in aggregate, take the individual over the new threshold.. Nevertheless, it could be seen as the thin edge of the wedge for future change.

Impact

Overall, it is good news. The primary purpose of a pension is after all to provide an income in retirement, and not to provide lumps sums or nice inheritances. There is therefore a logic to applying the changes to income benefits and not lump sums. The proposed changes are however a long way from the total ‘abolition’ of the LTA, and an opportunity to regain some of the hard-won simplification of 2006 has certainly been lost.

|