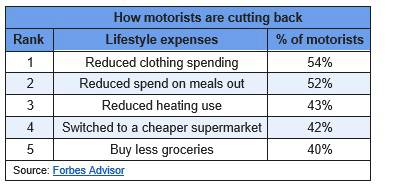

Clothing (54%) and meals out (52%) top the list of cutbacks. Young people feel the most significant effect on their finances, with 58% of the 18-34 demographic stripping back non-car spending to keep it running. The average motorist has seen a £98 increase in their car insurance over the past year.

Almost one in five (18%) British motorists – around 7.5 million people – are turning down their heating to free-up money to pay for the increased costs of running their car, according to research from Forbes Advisor, the price comparison and financial guidance website.

The study looks at how the nation has been affected by rises in vehicle running costs, finding that 92% of Brits are seeing sharp increases in their motoring expenses this year, with fuel and insurance accounting for the biggest surge in costs.

The study shows car ownership is contributing to the continuing cost-of-living crisis, with over four in 10 (42%) motorists cutting back on spending or making changes to their lifestyle to afford running their car. Clothing tops the cutbacks list, with over half (54%) of drivers buying less garb to keep their engine going. Going out for meals has seen a similar fate, with 52% of respondents cutting back on their spending at restaurants.

Although increased car costs are affecting the nation as a whole, younger drivers have been hit particularly hard. More than half (58%) of those aged 18-34 say they have reduced various lifestyle expenses to keep their car running – 16 percentage points higher than the national figure of 42%. This may be why one in five young Brits (20%) admit to considering selling their car, compared with just 3% of those aged 55 or older.

Amid rising inflation, 92% of the population have seen increases in the cost of running a car in the past year, with 71% seeing the cost of refuelling their car go up. The average price of a litre of petrol is now 157p as of 1 October, an increase of 9.6% since June[2].

Car insurance has also been on the rise, with six in 10 motorists (61%) seeing their premium rise in the last 12 months. The Association of British Insurers reported drivers paid an average of £511 for private comprehensive motor insurance in the second quarter of 2023[3] – a 21% increase on the same period in 2022. It’s not just the costs of running the car itself that are increasing either – 40% of survey respondents saw an increase in parking fees, too.

Kevin Pratt, car insurance expert for Forbes Advisor, said: “Car insurance hikes are causing a lot of financial hardship. Our research found that the average motorist has seen their car insurance increase by £98 in the past 12 months. The figure is even worse for 18-34-year-olds, who are seeing an average price increase of £132 to their insurance in just one year.

“Insurers are putting up prices because their own costs are rising, with car repairs costing more and taking longer thanks to a shortage of trained staff and supply chain bottlenecks. And like other businesses, they’re paying higher energy bills and wage costs - these all get passed on.

“We’re unlikely to see premiums fall until levels of inflation across the economy begin to drop, and although it’s trending in the right direction, the fragile state of the world economy and worrying geopolitical instability mean it’s likely to remain an issue well into next year. Much can be said, for the same reasons, for fuel prices.

“If you’re coming up to renewal for your car insurance, start shopping around early as insurers charge more the nearer you get to renewal. Receiving your renewal notice from your current insurer is a good indicator that it’s time to start hunting a better deal - never automatically renew without checking what else is available.”

|