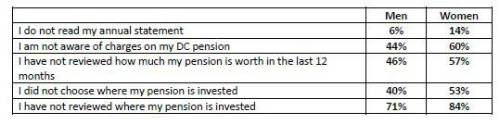

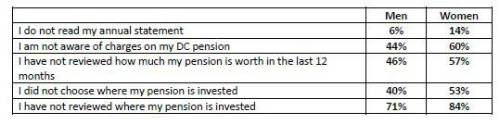

Figures from the FCA’s comprehensive Financial Lives survey show a high proportion of people are not taking an interest in pension matters which could have a disproportionate impact on women, whose lower value pensions make them more vulnerable to poor choices.

“Sending out information is easy, but the hard part is presenting it in a form that engages and informs a wide range of people,” said Stephen Lowe, group communications director at retirement specialist Just Group.

“Most people say they do read their annual statement although the number who don’t is more than double that for women than men.

Anything more complex – knowing what the charges are or whether they choose the investments – shows much lower levels of engagement, especially among women.”

The FCA data on engagement with defined contribution pensions

He said that developments such as automatic enrolment into workplace schemes and good quality default investment funds have made it possible to accumulate decent pensions without being engaged, but that passive approach does not work as people reach the point of needing to access the cash.

Awareness of the entitlement to free, independent and impartial guidance from Pension Wise is not high among 45-55-year-olds, according to Just Group’s own research last year, but women (12%) are about half as likely to be aware as men (20%).

“The system works best where people who are engaged with their pensions have the freedom to make active decisions but those who are less interested are protected from harm,” said Stephen Lowe.

“The current weak point is where defined contribution savers start to make decisions about how best to use their funds, at this point they are most vulnerable to poor choices and to falling for scams.”

Guidance is a key plank of consumer protection, but user numbers are worryingly low. Pensions Minister Guy Opperman has stated the government’s ambition for it to become ‘the norm’ for people to use the Pension Wise session to which they are entitled.

“That will require a four or fivefold increase in current take-up which can only happen if the Department for Work and Pensions and FCA become far more ambitious with their interventions than they have been so far.

“Introducing wake-up packs at age 50 has not materially increased usage and the evidence from the ‘stronger nudge’ trials shows implementing this intervention will not deliver the usage level to which the government aspires.

“We need to plan to succeed, not plan to fail. An effective way to address this would be to automatically enrol people into pension guidance sessions, just as we do into workplace pensions. That way the least engaged, least knowledgeable and least confident are sure to receive the professional support of an expert to help talk through their options.

“They won’t even have to know such a service is available to still reap the benefits of it.”

|