The current push for buy-ins activity looks set to continue with 40% of defined benefit trustees targeting BPA as their end-game strategy expecting to approach an insurer in the next 12 months. The research from Standard Life among 100 DB trustees managing schemes with assets of £100m or more comes as the market for deals looks set to exceed £40bn again this year, with over 155 buy-in and buyout transactions completed by UK schemes in the first half of the year

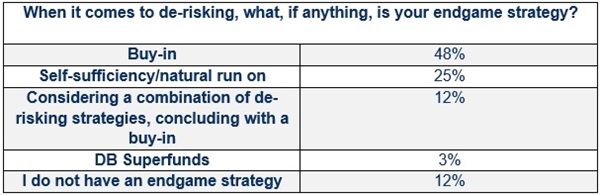

The research into trustee attitudes towards de-risking found that nearly half (48%) favour a bulk purchase annuity (BPA) as their preferred endgame strategy, with a further 12% considering a combined approach that concludes with a buy-in. Notably, demand is consistent across scheme sizes, as 47% of schemes with assets between £100m - £1bn and 49% of schemes with assets over £1bn identified buy-in as their endgame strategy and reinforces that scheme size does not influence appetite for insurance-based solutions.

While two fifths of trustees expect to approach an insurer about a buy-in deal within in the next twelve months, there was evidence of strong demand over longer timeframes. Of those schemes that are interested in approaching an insurer about a transaction, 30% are targeting a one to three-year timeframe and another 21% expecting to act within three to five years.

Strong funding levels have been a theme of recent years and the research found that 45% of trustees said their schemes are fully funded or in surplus. This improvement in funding levels has led to discussion about the range of different endgame strategies open to trustees and 25% are considering run on while superfunds remain a niche option, with only 3% of trustees actively exploring them.

Despite the availability of alternative options, the certainty and security offered by insurers is a key driver. Over a third (34%) of trustees said that the “certainty and security to scheme members that they will receive their pension income” was the most important reason that buy-in was being considered.

Claire Altman, Business Development & Origination Director at Standard Life, said: “While the evolving regulatory landscape and the Pension Schemes Bill have prompted important conversations around de-risking and the use of scheme surpluses, buy-in remains a key strategy for trustees aiming to secure member benefits and reduce risk. With nearly half of schemes now fully funded, insurance-based solutions are becoming more accessible and attractive due to the certainty they provide. This rising demand is reflected in market activity, with deal volumes expected to approach £40 billion by year-end. All signs point to continued momentum, as schemes look to lock in timelines and move forward with transactions.”

“The security afforded by this strategy is crucial for trustees and sponsors who are preparing to wind down their DB pension schemes. It’s clear that buy-in is not just a tactical move—it’s a strategic decision that aligns with long-term goals, removing uncertainty and allowing trustees to lock in member benefits.”

|