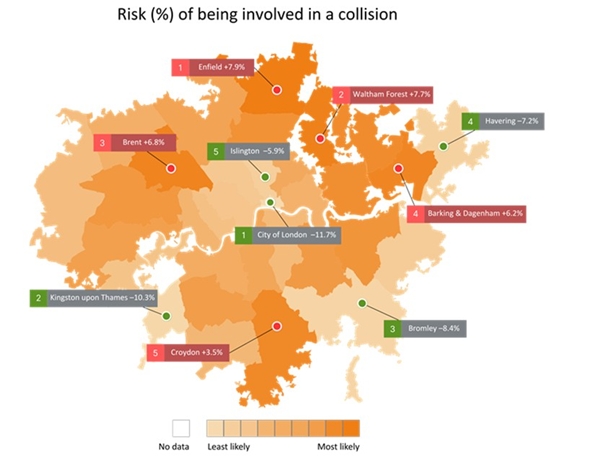

The most dangerous areas of London to drive in have been revealed, with Enfield topping the list. The new analysis from Europe’s leading provider of insurance and credit information, CRIF, finds motorists in the borough of Enfield are 8% more likely to be involved in a car accident than those based across the rest of London, with Waltham Forest, Brent, Barking, and Dagenham making up the rest of the top five most dangerous boroughs to drive in.

By contrast, the City of London has been found as the safest place - motorists are around 12% less likely to be involved in a collision. Kingston upon Thames, Bromley, Havering, and Islington are also among the safest boroughs for drivers.

The findings come from analytics produced by CRIF’s Traffic Exposure Score, which assesses and analyses factors that contribute to road accidents, helping insurance companies calculate risks for drivers more accurately, and in turn, offer more personalised pricing for motorists based on their locations.

The tool draws on a wide range of risk factors, including proximities to, as well as the amount of, bus stops, tube stations, train stations, motorway junctions, and speed cameras a driver is likely to encounter, based on where they are driving.

According to the data, motorway junctions are the biggest risk for drivers across Greater London, closely followed by speed cameras.

High insurance premiums leading to dangerous driving

The knock-on effect is that insurance premiums are likely to be higher for those drivers living in the riskiest areas (Enfield, Waltham Forest, Brent, Barking and Dagenham, Croydon), putting extra pressure on drivers’ finances at a time when motor insurance costs have increased dramatically.

While car insurance premiums have recently started to decline, they remain significantly above pre-pandemic levels. For example, The Association of British Insurers (ABI) shows that motor insurance premiums soared by 25% in 2023 alone, with a third (33%) of Brits believing that their insurance is now the most expensive it has ever been.

These high insurance premiums are adding to the danger on the road – CRIF’s research for its 2025 Banking on Banks report finds 5% of UK motorists (equating to 2.5 million driving license holders) say they have previously driven without motor insurance due to rising costs despite it being a legal requirement. A further 4 million admit they would consider it if necessary.

Sara Costantini, Regional Director for the UK & Ireland at CRIF said: “Our analysis shows the most dangerous and safest places to drive in the capital. This can have a major knock-on impact for those who live and drive there, with the likelihood that those in more dangerous areas will face higher insurance costs as a result. While premiums have started to decline, they remain firmly above pre-pandemic levels. This has led millions across the UK to drive without insurance, increasing the danger on our roads. By using refined, detailed data, including information on a driver’s location, insurance companies could offer fairer, more personalised premiums that ensure more people are covered for potential accidents.”

CRIF’s Traffic Exposure Score contributes to CRIF’s work to support the insurance and finance industries. Having previously launched in other European countries, and the UK last year, the Traffic Exposure Score has been proven to help insurers to reduce their loss ratio between 1.5 and 2.5%.

|