By M. Osman Javaid, Temple University, USA

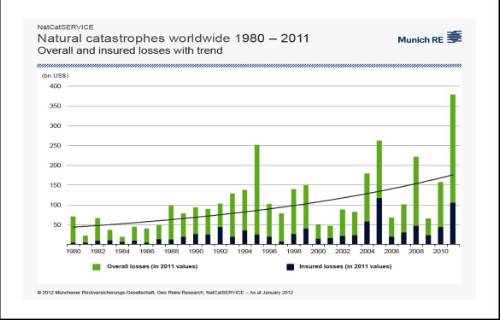

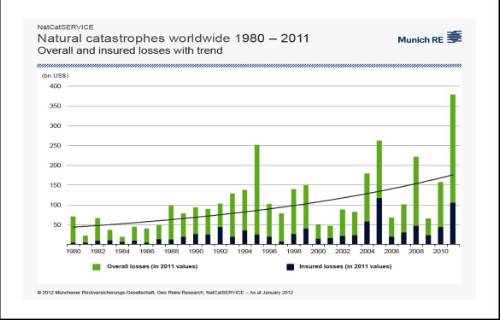

Over the last century, civilization has managed to cultivate a multidimensional concern known as global warming, which is now growing at an exponential rate. It is a phenomenon that is seen as an increase in the Earth’s temperature due to increasing carbon emissions. Global warming is represented by unusual changes in weather patterns such as excessive rainfall, droughts, unusual heat spells resulting in wild fires, tropical cyclones, and hurricanes. This dramatic increase in natural disasters has resulted in gargantuan losses for insurance companies. According to the German reinsurer, Munich-Re, global losses in 2011 related to devastating earthquakes and various weather-related catastrophes amounted to $380 billion; insured losses totaled $105 billion (Figure-1), which exceeds the record total of $101 billion in 2005.

Many leading insurers in the U.S. have reported catastrophic losses in 2011. Travelers Insurance, one of the leading property and casualty (P&C) insurers in the U.S., suffered $364 million in pre-tax losses in the second quarter of 2011 due to Hurricane Irene and Tropical Strom Lee. This is the first time since 2004 that Travelers has reported a loss according to Michael Kurinsky, ARM, a Pricing Analyst at Travelers. Kurinsky added that weather-related factors were accounted for in the Cat-models (Catastrophe-models), designed to help insurers model the frequency and severity of potential losses. However, the models missed the Black Swan occurrences – unexpected events of significantly large magnitudes. This recalls George E. P. Box, a Bayesian Statistician, who famously stated, “All the models are wrong, but some are useful.” Despite vast improvements over the past two decades, cataclysmic events are often missed by the Cat-models and by insurance companies that rely heavily on them to evaluate and manage risk. In addition, experienced ratemaking is no longer a reliable tool, as changing weather patterns are making past statistics deceptive. It raises the practical question: should P&C insurers move beyond the current risk evaluation approach?

Figure 1.

Insurers have become more dependent on Cat-models despite the fact that these models have a degree of uncertainty in them. Cat-models combine many high-severity, low-frequency events by extrapolating historical data and current weather patterns. These models do not simulate every possible event in every location, and the distributions are bounded by scientific opinion based on current research. Scientists are predicting that the relatively recent effect of climate change is proving that the future is going to be significantly different from the past, rendering historically-based models deficient. Additionally, insurers in the U.S. typically limit insured values by ZIP Code, which does not capture the included structures’ exact locations and physical characteristics. It is not accurate enough to predict major tornados, hurricanes, and earthquakes, as these can result in severe losses in large and highly populated areas. Instead, individually coding structures’ exact locations and physical characteristics will lower standard deviation, which is favorable for insurers. This is a time-consuming task but implementation can certainly help insurers for enhanced risk preparation.

Until recently, the insurance industry has been using experience rating to determine premiums on many property policies. Experience rating is becoming more and more complex due to the increased frequency of mass magnitude disasters caused by global warming. This has now directed insurers to re-evaluate their underwriting practices. It is impossible to experience-rate these policies without either facing underwriting losses or charging higher premiums. Increasing premiums would make the policies less affordable for insured individuals, which would result in either the cancellation of the individual policies or the discontinuation of coverage in high-risk areas. Growing losses have led companies to raise premiums in order to remain solvent or else refuse to re-write business in areas with high frequency of catastrophes. Jay Fishman, Travelers’ CEO, is pushing premium increases after last year’s second quarter loss, forcing the company to assess whether its pricing models understated catastrophic risk. Mr. Fishman stated, "We can either make the decision that we're really smart and we've been unlucky, or we can make the decision that something different is happening.” Also due to climate change, Allstate has decreased the policies that it writes in Florida from 1.2 million to 400,000, as recent hurricanes wiped out all of the profit it had garnered in 75 years of selling homeowners’ insurance in the state, according to Climate Action Programme. The company has curtailed activity in nearly a dozen other states. Hence, global warming has rendered the current private insurers’ pricing practice and Cat-models unworkable.

Rising insurance premiums, policy cancelations, and refusals to re-write businesses widens coverage gaps and places more pressure on Federal Insurance Programs (FIP). In the past, the government was not successful in managing FIP’s, and the programs are still slow and inefficient. The National Flood Insurance Program (NFIP), which is part of the FIP, provides subsidized flood insurance to homeowners on high-risk floodplains. After almost 35 years, the NFIP remains severely dysfunctional. A study by Wharton has concluded that prices charged by private insurers could be lower than current prices charged by the NFIP. Competitive Enterprise Institute stated in a report, “The maps used to determine flood rates are outdated, so whatever the NFIP’s official statistics, it appears highly likely that the actual numbers are wrong.” Robert Meyer, Co-Director of Risk Management at the Wharton School, highlighted in the article Counting the Cost of Calamities, that as a result of NFIP subsidies, people routinely rebuild in areas that have already been devastated. Thus, past experiences have established that the government-funded insurance programs are inefficient in lowering prices and preventing losses.

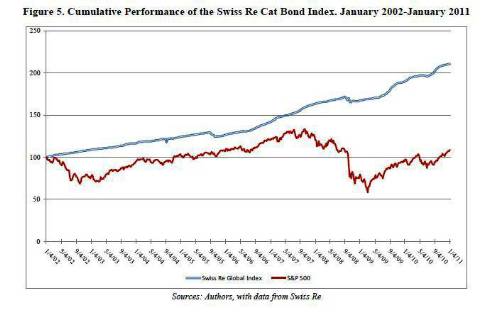

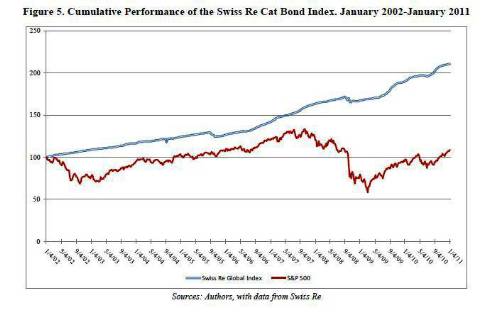

As these federal programs prove to be insufficient, insurers should move towards other alternatives, such as Cat-bonds ¬¬– a financing tool that can help insurers fund Cat losses – and Industry Loss Warranties (ILW) – a financing tool that “cover losses from events where industry-wide insured losses exceeds some pre-agreed threshold.” For example, an ILW may promise to pay an insurer if a hurricane incurs insured loss in Florida in excess of $15 billion but less than $25 billion. There has been a marked increase in demand for these instruments. In the past decade, worldwide reinsurers have increasingly used Cat-bonds and ILW to transfer risk. This has now proven to be an impeccable decision as insurers face payouts for the most expensive hurricanes in U.S history. Figure-2 illustrates the successful cumulative performance of the Swiss-Re Cat-bond index against the S&P 500. The vast spread shows high return on Cat-bonds that attracts professional investors, such as banks and investment institutions, creating a new market for Cat-bonds. Primary U.S. insurers, apart from carrying reinsurance coverage, should also put Cat-bonds and ILWs into consideration to diversify risk and offset future losses. Cat-bonds have high yields, which makes them attractive in the current low-interest-rate environment. Tim McDermott, Risk Analyst at Munich-Re and former President of Gamma Iota Sigma at Temple University added, “Cat-bonds are not correlated with equities, which provides a great way to diversify investment portfolio.” Mr. McDermott further explained, as the cost to administer ILWs is low, a diversified ILW portfolio, in addition to reinsurance, can keep the insurance industry secure and financially healthy.

Figure 2.

In addition to using securitization, insurers should upgrade and enhance their models. Firstly, making some of the methodologies more transparent and sharing data more openly with scientists, researchers and public policy institutions that take climate change into account can improve the models. Participating in ClimateWise, a cross-industry body of insurers set up to tackle climate change impacts, would assist insurers in business operations, stated, Neil Smith, Manager of Exposure Management at Lloyd’s. Secondly, as the future will be significantly different from the past, insurers should give more consideration to short-term forecasting techniques; periods of one to two years as compared to the long-range periods of five, ten, or more years. More importantly, the use of models with parametric uncertainty (PE) – uncertainty in the parameters or input into the model – should be avoided. Mr. Smith stated that PE fools insurers as it leads to large estimation errors for many policies, resulting in large unexpected losses. It is also vital to reflect improved location coding in models and better understanding of weather trends while models are being designed and implemented. Actuaries should spend more time investigating models’ accuracy, verifying data quality and improving predictive modelling methods. An increased understanding of models’ mechanism, regulations, and quality of data by the underwriters can lead to informed decisions and accurate pricing.

Shifting some resources from Cat-models to other methods for assessing risk, such as utilizing underwriters expertise over models, alternative ratemaking systems, high-deductible plans for high-risk areas, in-depth inclusion analysis for low-lying plains, and concise examination of policy forms and coverage contracts, will lead to enhanced understanding of potential losses. Karen Clark, pioneer of Cat-models and CEO of Karen Clark & Company stressed, that for the last 20 years, the insurance industry has moved to the other end of the spectrum, which is all models and no underwriters. Insurers have to keep in mind that models are just approximations and only provide estimates, not answers. The models can get you in the ballpark, but the underwriting knowledge and expertise can give you a better, more focused view of individual risk. Underwriters should incorporate differentiated analysis by modifying sub-limits for both named perils and coverage types in high-risk areas. Moreover, insurers should revise policies and rates for Business Interruption (BI) and Contingent Business Interruption (CBI) coverage in areas with high frequency of catastrophes. Actuaries and underwriters should collaborate to build a CBI model in order to predict losses accurately, as CBI models do not exist.

Furthermore, insurers need to promote and implement other practices that can help reduce global warming and its effects. Munich-Re, Chartis, and Travelers Insurance recently designed and introduced Carbon Credit Delivery Insurance, which will help reduce carbon in the atmosphere. Insurers giving premium discounts and incentives to drivers of hybrid-electric vehicles can also motivate consumers more towards their use. Increased creation of environmental friendly, innovative insurance products such as Micro-Insurance, Green-Buildings’ Insurance and Pay-As-You-Drive Insurance can make the infrastructure less vulnerable to insured individual losses. Most importantly, by taking into consideration the probable executive decisions and actions due to climate change risk under the Directors and Officers Liability Insurance will keep the industry secure.

Global warming is the outcome of decades of damage and is becoming a huge concern for insurers, reinsurers and the federal government. It might take generations to undo this damage, as there is no quick fix, and an aggressive approach is needed to curb global warming. Many top insurers are educating themselves about the cli¬mate change risks and Cat-models, and are motivated in their efforts to bring about change. Considering the few recommendations mentioned above can keep insurers financially stable. Securitization, upgraded and enhanced models, and concise exam of coverage forms and contracts can be effective for insurers. Due to the economic recession and financial instability, insurers should rely more on underwriting knowledge and analytical skills instead of investment returns to cover losses and expenses. The insurance industry is very proactive, reactive and innovative but regardless of their actions, insurance premiums will now rise. However, if insurance companies take the necessary actions immediately, we can expect to see a self-sustaining industry in the future.

|