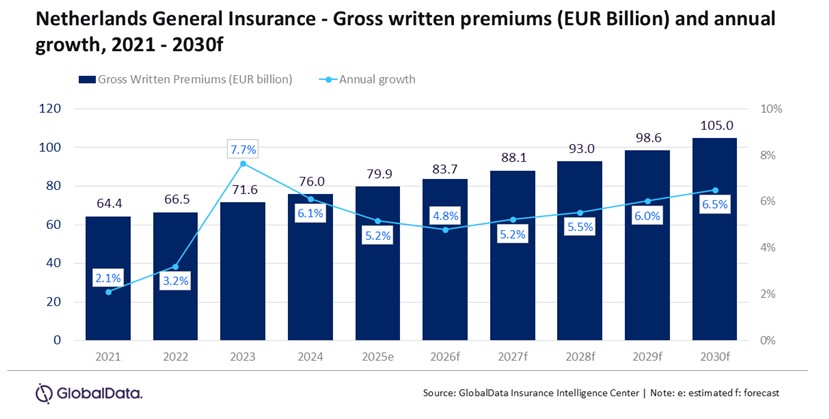

According to GlobalData’s Global Insurance Database, the general insurance market in the Netherlands is estimated to register an annual growth rate of 5.2% in 2025, driven by digital transformation, regulatory changes, rising healthcare costs, growing demand for cyber and catastrophe coverage, and product innovation. Personal accident and health (PA&H), motor, and property insurance combined are expected to account for 96.2% of general insurance GWP in 2025.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: " The sustained growth of the Dutch general insurance industry is indicative of the resilience and adaptability in the face of evolving market dynamics and consumer needs.”

PA&H insurance is the largest line of business and is expected to account for 82.4% of general insurance GWP in 2025. The PA&H insurance GWP grew at a CAGR of 5.6% during 2021-25 and is expected to grow at a CAGR of 5.8% during 2026-30, fueled by increasing healthcare costs and an aging population, which are pushing up premiums.

PA&H insurance premium growth is also supported by rising health awareness, a surge in chronic health conditions, and higher wages for healthcare personnel. According to Statistics Netherlands, the out-of-pocket healthcare expenditure has increased by 7.5% in 2025. Also, healthcare expenditure as a percentage of GDP has risen from 9.8% in 2023 to 10% in 2024.

Sahoo adds: “Dutch insurers are employing technology to improve customer interactions, refine policy offerings, and boost operational efficiency. For instance, mental well-being, an area of concern among the Dutch population, is being supported through mental health assistance using digital resources and online platforms.”

Motor insurance, the second largest line of business with an estimated share of 7.5% in 2025, is expected to register steady growth during 2026-30. This growth will be supported by a growing vehicle fleet and electric vehicle (EV) adoption. The rise of shared mobility and gig economy platforms is also driving demand for flexible, on-demand insurance products.

According to the European Automobile Manufacturers Association, the Netherlands is among the top four markets in the EU in terms of electric car adoption. During January-September 2025, of the total vehicles sold, 34.7% were battery electric vehicles (BEV), 28.3% were hybrid electric (HEV), and 20.4% were plug-in hybrid electric (PHEV). Also, total vehicle sales in 2025 are expected to surpass the 2024 figures.

Sahoo continues: “The integration of solar and renewable energy assets into EV charging infrastructure introduces new risk exposures for insurers, particularly regarding grid management and battery degradation. Hence, insurers need to consider such evolving risks while underwriting policies.”

Property insurance is the third-largest line of business with an estimated 6.4% share of the general insurance GWP in 2025. The growth of property insurance will be supported by increasing repair and reconstruction costs due to stringent building regulations. The Netherlands faces rising flood risks due to climate change, prompting insurers to adjust their offerings to cover property values rather than replacement costs. Also, home insurance premiums increased by around 15% in 2025 due to inflation and losses incurred from climate-related disasters, which will support property insurance to grow at a CAGR of 6.4% during 2026-30.

Other general insurance lines, such as financial lines, liability and marine, aviation, and transit, are estimated to account for the remaining 3.8% share of the general insurance GWP in 2025.

Sahoo concludes: "The Dutch general insurance market will continue its upward trajectory through 2030. As insurers adapt to new risks, ranging from cyber threats to climate-related catastrophes, they are investing in technology, expanding their product portfolios, and embracing sustainability to meet evolving customer needs. With annual growth rates on the rise, the industry is well-positioned to deliver comprehensive protection and financial resilience."

|