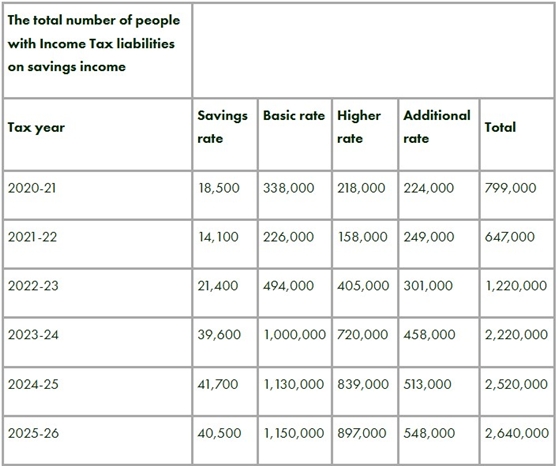

The number of people paying tax on their savings income is set to quadruple in just four years, according to new data obtained by AJ Bell. A Freedom of Information request reveals that 2.64 million people are expected to be hit with tax on their savings in the 2025/26 tax year – up from just 647,000 in 2021/22.

The rise comes as interest rates have soared and the Personal Savings Allowance (PSA) has remained frozen for over nine years. The PSA allows basic rate taxpayers to earn up to £1,000 in savings interest tax-free, while higher rate taxpayers get just £500. Additional rate taxpayers get no allowance at all and pay tax on all interest earned outside of tax-free wrappers like ISAs.

The figures show that the number of basic rate taxpayers facing savings tax will rise from 494,000 in 2022/23 to a projected 1.15 million by 2025/26 – more than doubling in just three years. Meanwhile, the number of higher rate taxpayers affected will surge from 405,000 to 897,000 over the same period.

Interestingly, these figures show HMRC are handing more people tax bills on savings interest than previously forecast. A similar FOI request submitted by AJ Bell in 2024 showed HMRC at the time projected 2.1 million savers would be taxed in 2024/25, but the estimate has since risen over 25% to 2.52 million. By 2025/26, the figure is expected to climb to 2.64 million.

It means that one in 25 basic-rate taxpayers will pay tax on their savings this tax year, up from less than 1 in 100 four years ago. And one in eight higher rate taxpayers will be handing over some of their savings interest to HMRC – a jump from the 1 in 25 that were four years ago. On top of that, 45% of all additional rate taxpayers are paying tax on their savings interest.

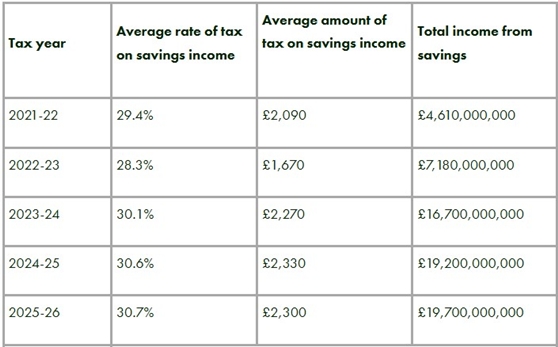

Source: HMRC/AJ Bell FOI. The 2020-21 and 2021-22 figures are based on the Survey of Personal Incomes (SPI). The 2023-24, 2024-25 and 2025-26 figures are estimates.

Laura Suter, Director of Personal Finance at AJ Bell, comments: "The government has frozen tax thresholds and left the Personal Savings Allowance untouched since it was introduced more than nine years ago. With interest rates rising sharply, more savers are being dragged into the tax net without any policy change – it’s tax by stealth. What was once a tax affecting wealthier savers is now catching out everyday basic rate taxpayers. Many won’t realise they’ve breached their allowance until HMRC comes knocking. These numbers highlight how the rising tide of interest rates has swept hundreds of thousands more savers into the tax bracket. The government may be benefitting from increased revenue, but many ordinary savers are worse off. Using tax wrappers like cash ISAs or investment ISAs is now more important than ever to protect your savings from the taxman.

“For years, most savers didn’t give a second thought to paying tax on their interest – rates were low and the Personal Savings Allowance offered a generous cushion. But the landscape has changed rapidly. A combination of rising interest rates, frozen tax thresholds, more people being pushed into higher tax bands, and years of cash ISAs being overlooked means many are now being pulled into the tax net for the first time. Savers have long had to weigh up whether to chase the highest rate or shelter their money in an ISA, but with ISA rates now far more competitive, one of the key barriers has disappeared. That’s helped more people act to avoid tax on their interest.”

Payslip deduction a nasty surprise

“For those who have moved their money to better-paying accounts and find themselves breaching the tax-free limit, many won’t realise until the taxman catches up. Self-assessment filers will need to declare any interest earned, but for those on PAYE, HMRC will collect the data directly from their payslip by adjusting their tax code. That can lead to a nasty surprise when people see their take-home pay suddenly fall.

“Notification that your tax code has been changed will often arrive in the form of an HMRC envelope landing on your doorstep. The ‘P800’ form will tell you if your tax code is changing, which allows HMRC to collect a little more tax from your payslip to make up for anything owed. The higher-than-expected volume of people paying tax on savings interest prompted HMRC to issue a warning earlier this year that the letters may not be dispatched until March, just weeks before the start of the new tax year.

“HMRC makes its calculations based on data it receives from banks and building societies covering accounts held by tens of millions of taxpayers. The taxman then has to match the banks’ records – which are transferred, quite literally, in a spreadsheet – against its own income tax data to work out who it needs to collect more tax from. The antiquated process, combined with the long reporting lag (see below), is the reason taxpayers often find out late in the day that money will be deducted from their payslip or pension because they owe tax on savings income.

“Astonishingly, HRMC says it cannot reconcile bank account interest with taxpayer data in around a fifth of cases, costing hundreds of millions in uncollected tax revenue. While that’s a win for the lucky taxpayers who are let off the hook by HMRC’s systems, it illustrates that the current approach is error-prone, so it’s always worth double-checking the taxman’s sums to ensure you’re not overpaying.”

The £6bn savings tax bill

“Falling foul of the savings tax trap can be costly. Figures disclosed to AJ Bell show the average person is paying £2,300 in tax on their savings, with an average effective rate of tax of about 31% - although tax is charged at the individual’s marginal rate of either 20%, 40% or 45%, the average rate of tax indicates the typical percentage sent to the taxman once tax-free allowances have been factored in. The amount of income earned on savings has skyrocketed as interest rates have increased and tax bands have been frozen, creating a welcome windfall for the cash-strapped Treasury. Brits will earn around £20bn from non-ISA cash accounts this year, a more than fourfold increase over a five year period. That boon for savers has turned into a bounty for the taxman. It expects to collect more than £6 billion when it takes its slice of the income earned by savers in the current tax year.”

|