By Alex White FIA C.Act, Managing Director, Co-Head of ALM at Gallagher

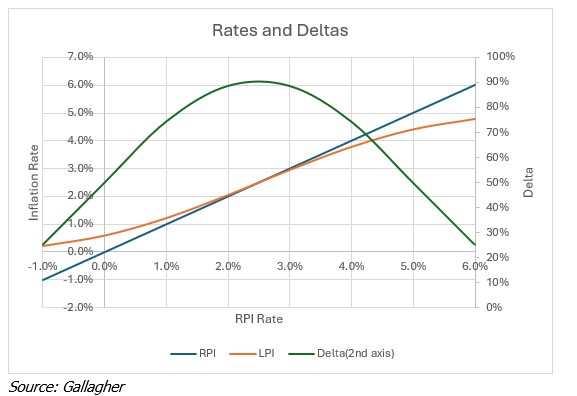

Firstly, options do not have 100% sensitivity to the underlying. If inflation moves closer to either strike, that option becomes more valuable, which means LPI moves by slightly less than RPI. It has a delta.

For the same reason, it also has a spread. If RPI is -1%, LPI0-5 will always be greater than zero, so in the extremes there will be a difference between LPI and RPI rates. Since both are continuous, even when RPI is within the range, there will still be some differences. We can see this in the chart below for a Bachelier model with 1.5% volatility.

These impacts can be material, as different models can lead to meaningfully different prices and sensitivities. But there is a further, second order consequence, in terms of how to attribute IE01 to different tenor points. The simplest is to attribute IE01 to the point of payment, and often this is adequate, but it does gloss over some subtleties.

Suppose you have a payment in 20 years’ time, from a deferred member who’s retiring in 10 years. You have 10 years’ sensitivity to pre-retirement inflation (which is often de facto RPI, as caps and floors tend to be global rather than annual), then 10 years’ sensitivity to post retirement inflation. More specifically, you have sensitivity to 10y pre-retirement, then 10y-20y post-retirement. This can be broken down as long 10y pre-retirement inflation, short 10y post-retirement, long 20y post-retirement.

If pre- and post- retirement inflation are the same, these cancel out. But if the deltas are different, you get different sensitivities. In an extreme case, suppose indexation were RPI pre-retirement, and flat post-retirement. Then all the sensitivity would be at the point of retirement, not at the point of payment.

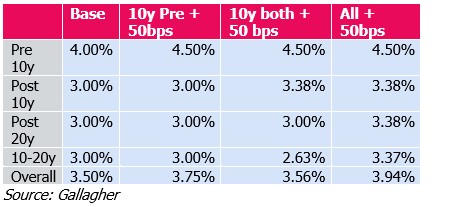

The table below works through a dummy example, where inflation is 4% before retirement with a delta of 100%, and 3% after retirement with a delta of 75%. Because the deltas are different, the pre- and post-retirement inflation rates move by different amounts. This means the 10-20y forward rate does not perfectly offset any increase in just 10y inflation, which in turn means the final payment is sensitive to changes in the rate at the tenor point of retirement. That is, the payment is not just sensitive to the final point, but to points along the curve. In this example, roughly 14% (6/44) of the sensitivity is at the 10y point.

This is unlikely to be hugely material in most cases (and if so, there are further subtleties on this idea, including how a change at each tenor point causes a subtly different set of forward rates). But sometimes it can matter, such as if a scheme had done a pensioner buy-in and the residual liabilities were mostly deferred. So, like a lot of these more nuanced issues, it’s worth being aware of it.

Disclaimer:

For professional investors only. Not suitable for private customers.

The information herein was obtained from various sources. We do not guarantee every aspect of its accuracy. The information is for your private information. This is not advice and should not be relied upon to make any decisions. A variety of market factors and assumptions may affect this analysis, and this analysis does not reflect all possible loss scenarios. There is no certainty that the parameters and assumptions used in this analysis can be duplicated with actual trades. This document is based on information available at the date of publication and takes no account of subsequent developments after that data. Further, any historical exchange rates, interest rates or other reference rates or prices which appear above are not necessarily indicative of future exchange rates, interest rates, or other reference rates or prices. Neither the information, recommendations or opinions expressed herein constitutes an offer to buy or sell any securities, futures, options, or investment products on your behalf. Unless otherwise stated, any pricing information in this document is indicative only, is subject to change and is not an offer to transact. Where relevant, the price quoted is exclusive of tax and delivery costs. Any reference to the terms of executed transactions should be treated as preliminary and subject to further due diligence.

We do not advise on all implications of the transactions described herein. This information is for discussion purposes and prior to undertaking any trade, you should also discuss with your professional tax, accounting and / or other relevant advisers how such particular trade(s) affect you. All analysis (whether in respect of tax, accounting, law or of any other nature), should be treated as illustrative only and not relied upon as accurate. No reproduction, copy, transmission or translation in whole or in part of this document may be made without our prior permission.

Gallagher Benefit Services is a trading name in the UK for Gallagher Risk & Reward Limited (Company Number: 3265272), Gallagher Communication Ltd (Company Number: 3688114), Gallagher Actuarial Consultants Limited (Company Number: 1615055), Gallagher (Administration & Investment) Limited (Company Number: 1034719), Gallagher Consultants (Healthcare) Limited (Company Number: 172919) and Redington Limited (Company Number: 6660006) which all have their registered offices at The Walbrook Building, 25 Walbrook, London EC4N 8AW. All the companies listed are private limited liability companies registered in England and Wales. Gallagher Risk & Reward Limited, Gallagher (Administration & Investment) Limited, Gallagher Consultants (Healthcare) Limited and Redington Limited are authorised and regulated by the Financial Conduct Authority.

|