The generosity does not extend just to money – nearly a million over-65s have adult children and other family living with them.

MetLife believes the money owed by adult children underlines the squeeze on retirement income and highlights the need for retired people to plan ahead for potential financial shocks

-

The average loan is £3,100 but one in 10 are owed £5,000 or more, MetLife’s Cost of Retirement Index shows

-

Nearly one million over-65s have children living with them

-

Nearly one in four (23%) of over-65s are owed money by their adult children highlighting the financial pressures on retired people, new research from MetLife* shows.

Its Cost of Retirement index, which looks at the finances of the UK’s 10 million-plus retired people, shows the average owed by adult children to their retired parents is a substantial £3,100 with one in 10 owed more than £5,000,

The generosity does not just to extend to lending money – nearly a million over-65s have adult children and family living with them.

MetLife believes the money owed by adult children underlines the squeeze on retirement income and highlights the need for retired people to plan ahead for potential financial shocks.

Dominic Grinstead, Managing Director, MetLife UK, said: “Being able to lend adult children money is important to millions of retired people and many can definitely afford to do so and are happy to pay out.

“But the fact that so many are helping out adult children demonstrates that people need flexibility in their finances in order to be able to fund potential financial surprises.

It is guaranteed that there will be financial shocks in retirement and a need to find money at short notice for a range of issues which underlines why flexibility is so important for retirement income solutions.”

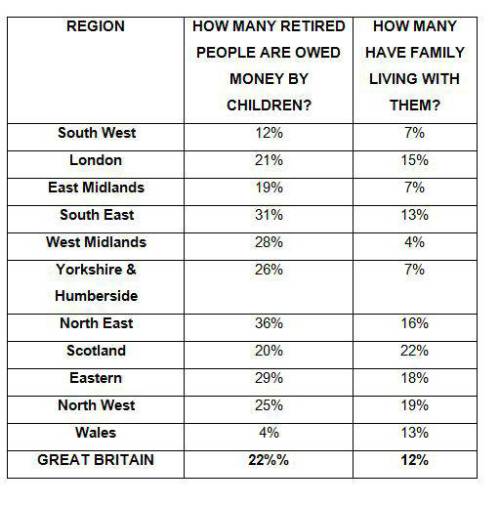

The table below reveals the differences across the country in how many retired people are owed money by their adult children and how many have family living with them.

MetLife is seeing strong demand coming through as advisers and clients who have held off ahead of the start of pension freedoms take advantage of the new rules providing increased flexibility.

MetLife’s income and capital guarantees are already well suited for clients who want to benefit from certainty and flexibility by offering a guaranteed income for life as well as the opportunity for growth. Its range includes the innovative Retirement Portfolio as well as guaranteed bonds. Customers are able to withdraw additional funds free of charge in line with MetLife’s commitment to full flexibility.

|