Fewer than half of workers aged 60+ feel prepared for retirement, raising concerns about the adequacy of support for people preparing for life after work.

New research into the experiences and attitudes of the ‘Baby Boom’ generation born between 1946-64 – part of the GenVoices programme from retirement specialist Just Group – reveals many approaching, and at State Pension age but still working, are not confident about their retirement preparations.

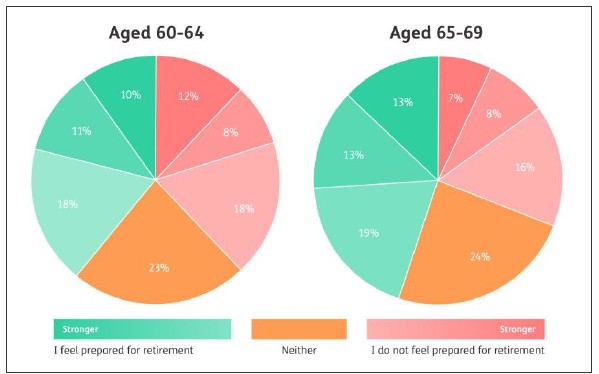

Among the 60-64 age group more than three-quarters (76%) had not retired. Of these, 39% said they felt prepared for retirement with 38% saying they did not feel prepared with 23% feeling neither prepared nor unprepared.

For the age 65-69 cohort which straddles State Pension Age, one-third (31%) were yet to retire. Of these, 45% said they felt prepared for retirement while 31% felt unprepared, with 24% neither prepared nor unprepared.

Stephen Lowe, group communications director at retirement specialist Just Group, said: “There are more than three million working people aged between 60-69 in the UK and our figures suggest that at best a million feel prepared for the step into retirement. There’s a clear split between those who are approaching retirement with confidence and those who don’t feel prepared, plus a significant minority in the middle unable to answer one way or the other. Retirement decisions – when to stop work, how to take pension income, how to plan for later life – can be daunting. It’s likely many people feel unsupported or unsure where to start.”

He said that the research shows that about three-quarters of working Baby Boomers have a workplace pension, but this is split between 45% with a defined contribution pension and 39% with a defined benefit pension (only 10% have both). 17% have never had a workplace pension and a further 10% aren’t sure.

“There’s an assumption that most Baby Boomers have defined benefit pensions but a larger proportion have defined contribution arrangements where they will have to choose how best to access their pension money, balancing taking the cash they need while ensuring the fund keeps paying for as long as they need it.

He said that it was important to use the resources available, including advice or guidance offered by an employer or the scheme, and potentially a regulated adviser. He recommended everyone should use the free, independent and impartial government-backed Pension Wise service, which is aimed at helping those people considering accessing defined contribution pensions. The service receives very positive ratings from its users.

“Forward-thinking employers and pension companies are putting more resources into place to help people in the run-up to and at retirement,” said Stephen Lowe. “It’s important that people recognise the value of the support that is available and take advantage of it.”

|