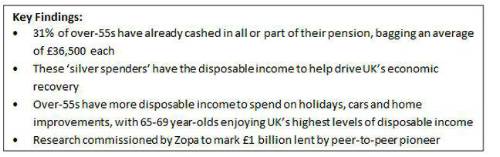

Changes to pension legislation have made over-55s into Britain’s most cash-rich consumers, says research by Zopa

The sheer numbers that have already taken advantage of these changes could make them the driving force in Britain’s economic recovery as pension freedoms provide greater flexibility and access to cash. Of those that have pensions additional to the state pension over the age of 55, 31% said they had already cashed in some or all of it, while a further 6% said they planned to do so in future. 10% had cashed in the maximum tax-free lump sum of 25%, while the average sum taken was £36,500.

Significantly, much of this money looks set to be used for consumer spending. Almost half (49%) of over-55s said they don’t struggle to find money to fund lifestyle purchases, compared to a minority of 18-34s (24%) and 35-54s (27%). Due to lower financial obligations such as mortgage repayments or rent the older age group also spend a higher proportion of their disposable income on cars, home improvements, holidays and charitable donations than other age groups.

Increasing their level of disposable income was the most common reason for having cashed in a pension (30%) among those who had done so, closely followed by finding more money with which to travel (27%) or undertake home improvements (18%). By contrast, only 11% had done so to pay off their mortgage. Those in the 65-69 age group were found to be more cash-rich than any other age group, with 27% of their income seen as ‘disposable’.

Giles Andrews, co-founder and CEO, Zopa, comments: “The ‘silver pound’ has never been stronger. 57% of the £1bn lent by Zopa over the past decade has come from over-55s, a clear sign that P2P is fast becoming a mainstream for people looking for income or to grow their pension pot. Savvy consumers in this age group have greater freedom to use their disposable income with many looking for a reliable, predictable and low risk return to generate an income from their pension funds.”

In a separate survey of its own lenders, Zopa found a similar willingness to access pension funds for other uses. 28% of customers aged 55 and over said the new changes would mean they invested in more in peer-to-peer lending, while two thirds said they would opt to use peer-to-peer over a more traditional annuity scheme. Over 75% also said they would be willing to lend more through Zopa when peer-to-peer lending becomes allowable in an ISA from next April, so becomes tax free for that part at least.”

The findings come as Zopa announces that it has become the first UK peer-to peer lender to surpass £1 billion in lending and over £50m in monthly volumes.

|