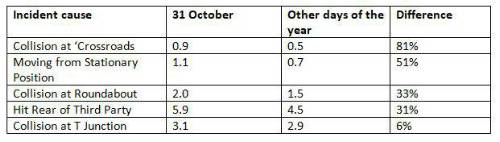

Analysis of internal driving data and associated claims reveal that there’s a greater chance of an accident caused by a number of different factors than at other times of the year. For example, the data shows an 81% increase in collisions at crossroads on Halloween compared to the rest of the year. Claims for collisions at roundabouts also rise 33% on 31 October compared to the rest of the year.

And rear end collisions increase 31% on the spookiest day of the year.

Analysis of ITBL customer claims for 2015-2018 per million miles driven. E.g. for every million miles driven there are 4.5 claims on average caused by rear-end collisions throughout the year; on Halloween specifically, there are 5.9 cases on average for every million miles driven.

Kelly Wilkins, Head of Customer Service, drive like a girl, said: “We urge drivers to take care at all times they are on the road, but October brings with it some added challenges - poor visibility, the reduction of natural daylight brought about by the October clock change, and the added distraction of trick or treaters out in groups celebrating the occasion.

“With excited children and adolescences, very often in amazing costumes, wanting to celebrate the night, there will be more activity on the streets on Thursday 31 October. Young, inexperienced drivers, may be easily distracted by the festivities and in that moment, an accident may occur.”

drive like a girl uses individual driving data to determine the risk profile of each policyholder through a black box installed in the vehicle.

It shares driving data with each customer through a personalised online portal, empowering them to manage their driving habits in order to reduce their insurance risk profile – and possibly their premiums. drive like a girl policies offer a fixed mileage of 7,000 miles of cover and Reward Points2 can be earned for driving safely.

|