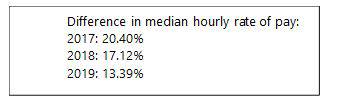

At 31 March 2019 the PPF’s median gender pay gap stood at 13 per cent, down from 17 per cent the previous year. The mean pay gap is 22.5 per cent (23.5 per cent in 2018); the organisation’s median bonus gap is 30.5 per cent (unchanged from 2018) and the mean bonus gap is 66 per cent (59 per cent in 2018). This is the PPF’s third year of reporting.

Katherine Easter, Chief People Officer at the PPF said: “We’re pleased to see that our efforts are driving a downward trend in our gender pay gap but we’re still some way from where we want to be.

“There are two reasons for our gender pay gap: we do not have enough women in senior positions; and we have a high concentration of men in highly paid roles in functions that are currently overrepresented by men in our industry, namely in our investment, risk and IT teams.

“Two years ago, when we signed the Women in Finance Charter, we committed to having 40 per cent of our senior roles filled by women by 2021. We hit this target early – 40 per cent was achieved in October 2019. We’ll build on this by continuing to nurture our own talent and making sure the PPF is an attractive workplace for women.

“While we recognise the wider challenge of recruiting women into male-dominated sectors, we are focusing our efforts on attracting women into our teams in a number of ways, including making sure the PPF is a great place for women to build their careers.”

The full gender pay gap report

|