Net surplus (on s179 basis) remains strong at £214bn; funding ratio rises to 125 per cent

Allocations to bonds (71 per cent) and equities (15 per cent) remain steady

Asset proportions held in annuities reach record high at almost 13 per cent

Proportion of pensioners (47 per cent) overtakes deferred members (45 per cent)

More notably, on an estimated full buy-out basis – the cost of securing full benefits with an insurer – the net funding position improved from a deficit of £69.5 billion last year to a deficit of £47.2 billion.

The size of the DB universe continued its gradual decline. The number of eligible DB schemes shrank from 4,974 schemes to 4,840 – a reduction of just over c.130 schemes or under 3 per cent – as schemes wound up, merged, or entered PPF assessment. The landscape remains highly fragmented: 80 per cent of schemes have fewer than 1,000 members yet account for only around 10 per cent of assets and liabilities, while schemes with more than 5,000 members hold almost three quarters of total assets despite representing just 6 per cent of schemes. Just under 80 per cent of schemes have assets of less than £100m.

Demographic trends remain broadly unchanged. Only 4 per cent of schemes remain open to new members, a share that has stayed constant since at least 2023. There are around 0.7 million active DB members – i.e. those who continue to accrue benefits; 20 years ago, in 2006, there were 3.6 million. Of the total 8.6 million members of DB schemes, the proportion of pensioners (47 per cent) overtook deferred members (45 per cent), showing the maturity of the sector.

Asset allocation trends continue to show a mature and de-risked universe. Schemes hold 71 per cent of their assets in bonds and bond proxies, similar to the 70 per cent last year, while the equity proportion remains steady at around 15 per cent. The long-term shift away from UK equities continues, with allocations now below 5 per cent of total equity holdings. The proportion of assets held in annuities has risen sharply to almost 13 per cent – the highest level ever recorded – reflecting higher volumes of buy-in transactions among schemes approaching buy-out.

Shalin Bhagwan, the PPF’s Chief Actuary, said: “In our 20th anniversary year, the 20th edition of The Purple Book provides valuable insight into the data and long-term trends shaping the UK corporate, defined benefit universe. This universe has significantly matured over the past two decades and this is increasingly reflected in asset allocations which, in turn, explains the stability over the past year. And while section 179 funding levels remain robust, the £47.2bn deficit on a buy-out basis is a reminder that as more schemes approach their endgame, the need for thoughtful long-term planning remains vital.”

Reflecting the continuing evolution of the DB system, this year the PPF has additionally included estimates of universe assets and liabilities under alternative measures and methods. This includes a scenario where s179 liabilities make an allowance for increases to pensions accrued before 6 April 1997 reflecting the recent government announcement at the Budget. We estimate that allowing for these ‘pre-97’ increases would increase universe liabilities on a s179 basis by around 12 per cent however this would have no direct impact on the more relevant funding measures for most schemes such as Technical Provisions (TPs) or buyout.

s179 valuation measure – This is the estimated value an insurance company would need to be paid to take on a defined benefit (DB) pension scheme and pay its members benefits equivalent to PPF compensation levels.PPF reserves – The PPF intentionally holds reserves to cover future risks, such as potential future claims on the fund and longevity risk of our current pension liabilities. As such, the reserves represent a contingent liability which could crystalise if these events were to occur – it is not a traditional ‘surplus’. Holding suitable reserves is vital so the PPF can provide financial security for its current and future members and reduce risks for levy payers. The PPF’s current £14bn reserve (as at 31 March 2025) ultimately underwrites the £1trn of liabilities in the c.5,000 remaining DB schemes in the UK.

The PPF Purple Book – 20 years of trends

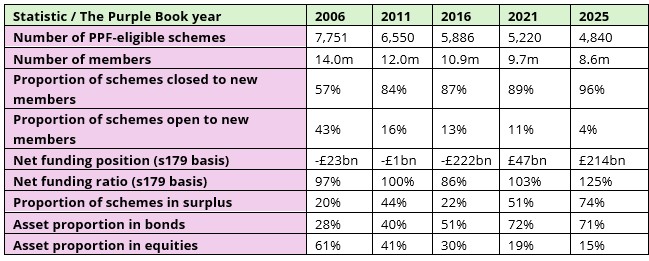

Table below summarises key Purple data at 5-year intervals starting from the first edition in 2006, with this year’s for comparison:

|