By Ian Aley, Head of Transactions and Gemma Millington, Senior Director, Transactions, WTW

This year's stress test introduces significant changes aimed at enhancing transparency and market discipline and, for the first time, individual firm results will be disclosed publicly.

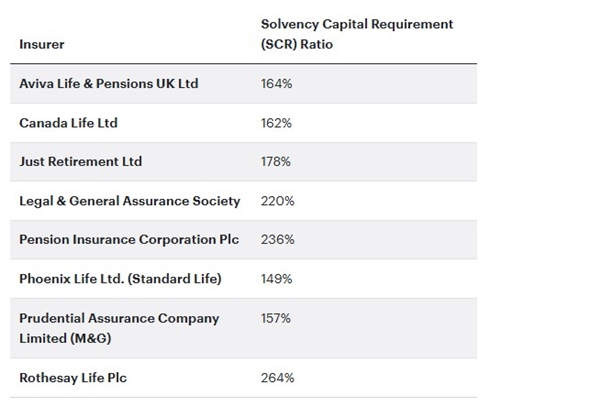

LIST25 applies to UK life insurers active in the Bulk Purchase Annuity (BPA) market with the largest annuity portfolios. Eight of the current insurers in the BPA market are in-scope - Aviva, Canada Life, Just, Legal & General, Phoenix (Standard Life), Pension Insurance Corporation, and Rothesay. With insurers having had until mid-year to submit their results, we are now approaching the publication of the results, which the market awaits with interest.

What are the objectives of LIST25?

Assess resilience: Evaluate both sector-wide and individual firm resilience to extreme financial and economic shocks

Strengthen market understanding: Individual firm results for the core scenario will be published publicly, alongside aggregate sector results for exploratory scenarios

Improve risk management insight: Identify vulnerabilities in insurers' business models and risk frameworks

What stress scenarios are being used?

The core scenario seeks to represent a severe global recession simulated through a three-stage financial market stress, including sharp declines in interest rates, equity and property values, and widening credit spreads. The core scenario is intended to represent a 1-in-100 market stress

This is then supplemented with exploratory scenarios:

Asset concentration stress: Impact of rating downgrades on the largest asset type in the Matching Adjustment portfolio

Funded re(insurance) stress: Effect of recapturing the most material funded reinsurance arrangement

Timeline

Firms were required to submit results by 16 June 2025

On 17 November 2025 – the PRA will issue it's main report which will set out the projected impact on the market as a whole under the core scenario

On 24 November 2025 – the PRA will issue a further annex to the report, which will provide output for each firm under the core scenario. This is the key new feature compared to 2022 and is clearly a more sensitive area, because analysts and potential buyers of bulk annuities will be able to see how each insurer's solvency is impacted and, to the extent there are differences, there is a question as to whether this should, and will impact decision making when selecting the counterparty for a bulk annuity

Interpreting the results

LIST25 is the first life insurance stress test conducted under the new Solvency UK regime, reflecting reforms to strengthen the UK's prudential framework. The exercise is not a pass-fail test and will not directly set capital requirements but aims to provide valuable insights for regulators, insurers, and stakeholders (including pension scheme trustees). The tests are being conducted with a backdrop of insurers having strong solvency capital ratios - all participants held capital in excess of 140% of that required at the time of the stress tests, consequently it is expected that the stresses will reveal a relatively robust position for most insurers.

The stress tests are based on the insurer's capital position as at 31 December 2024, the table below outlines the published position at this date (prior to stresses) for each firm submitting. A ratio above 100% indicates the extent of additional capital held over and above the solvency capital requirement, being the level at which the insurer can meet its obligations over the following year, with a 99.5% confidence. Analysing the results of the stresses will require considering a combination of:

The start point

The sensitivity to the stresses

The end point

The potential management actions

The insurer's likely access to capital in a stressed environment

|