By David Robbins, Director, Retirement and Glyn Bradley, Director, Retirement, WTW

On 14 November, after the Government had briefed journalists that income tax rates would not rise after all, ITV's Robert Peston reported that the Chancellor believes she can get the revenue she needs through a combination of measures that includes "abolishing the salary sacrifice scheme for pension contributions". That more dramatic change would be consistent with other recent reports that the Chancellor is looking for significant sums from salary sacrifice – for example from restricting the cost of bicycles purchased under the Cycle to Work scheme – but, at the time of writing, has not been confirmed elsewhere.

A large majority of revenue raised for the Exchequer from either change would come from employer National Insurance. This is slightly less the case with outright abolition (because this captures more employees paid £50,270 or less, who pay NICs at the main rate), but even there only around one quarter of the revenue would come from employee NICs.

As yet, there have been no reports that National Insurance relief on employer pension contributions that do not arise from salary sacrifice will be restricted or abolished. That was heavily trailed before the 2024 Budget but did not happen.

What is salary sacrifice?

Under salary sacrifice, an employee agrees to waive part of their contractual salary, replacing the amount waived with another benefit. Salary sacrifice is widely integrated into workplace pension designs because salaries are subject to both employer and employee National Insurance (NI), whereas employer pension contributions are NI-free. The main rate of employee National Insurance is currently 8%, with 2% payable on income above the Upper Earnings limit (£50,270). Employer National Insurance is charged at 15% on all earnings above the Secondary Threshold (currently £5,000).

For example, if an employee paying the main rate wanted to contribute £3,000 to a pension, doing this through salary sacrifice could save the employee £240 in employee NI, while the employer would save £450. Some employers directly share their NI saving with employees, using a proportion of it to fund an additional pension contribution; in other cases, the NI savings indirectly feed into the pay rises and other benefits that the employer offers.

Origins of a £2,000 cap

The idea of limiting salary sacrifice to £2,000 was first explored in a research report that HMRC commissioned under the previous Government.

A cap along these lines was by far the most moderate of three proposals explored with employers. The others were: (a) removing the National Insurance advantages of salary sacrifice altogether for both employees and employers (as implied by Robert Peston), and (b) not only removing NI breaks but also charging income tax on contributions paid by salary sacrifice. The second seemed punitive (presumably with the intention of stopping salary sacrifice altogether?) when pension withdrawals derived from these contributions will be largely taxable.

Unsurprisingly, employers who had just been shown more draconian ideas found a £2,000 cap an "easier pill to swallow", in the words of one. Nonetheless, the researchers noted that "most employers were still concerned that this scenario resulted in a reduction of benefits and... could disincentivise saving for a pension".

How much would this cost employers and employees?

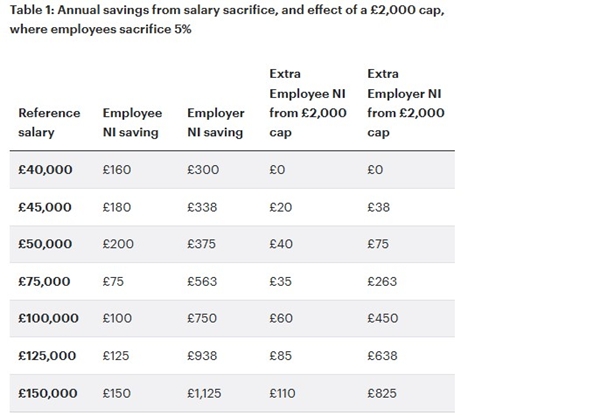

Table 1 shows the total NI savings for employees and employers where employees sacrifice 5% of their reference salary (without Lower Earnings Limit offset), at current NI rates. These would also be the additional NI costs if salary sacrifice were "abolished" altogether (i.e. by adding the sacrificed income back to the NI-able earnings). The table also shows the effect of a £2,000 cap relative to the current position.

As the table shows, the NI savings (and the extra NI from a cap) are overwhelmingly from the employer. At earnings levels where the main (8%) employee National Insurance rate is almost half of the employer rate (15%), a 5% contribution would either fit within the £2,000 limit or only just exceed it. Where people are paid enough for a 5% contribution to be worth significantly more than £2,000, the employee rate is only 2% and 88% of the extra NI due from the cap is employer NI. For a £100,000 reference salary, the extra employer NI in this example will cost as much as a 0.5% increase in the employer NI rate would.

Numbers affected

The Office for National Statistics was recently asked how many employees use salary sacrifice. It replied that, although it collects data on this, it does not process it. It previously estimated that, in 2019, around 30% of private sector employees were covered by pension salary sacrifice. Sacrifices must not reduce salaries below the minimum wage – an increasing consideration as minimum wage rates have risen faster than earnings overall.

Limiting NI advantages vs limiting salary sacrificed: effects on use of DB surplus

The £2,000 cap that HMRC tested with employers was described as meaning that: "employers and employees would not need to pay NI on any salary sacrificed up to £2,000 but would need to pay NI on any salary sacrificed above this amount."

This implies that it would still be possible to sacrifice higher amounts (rather than having to pay normal employee contributions) and that higher sacrifices would comprise a NIC-free component plus a NIC-able component. An alternative approach would be to cap sacrifices themselves at £2,000 per employee.

Similarly, if salary sacrifice were "abolished" altogether that could be achieved either through adding back any sacrificed earnings to NI-able earnings or through a formal ban on the use of sacrifice.

Which route the Government chooses could matter for employers who have agreed that DB surplus will be used to pay employer contributions and where this includes contributions originating from salary sacrifice. The Government has argued that releasing some of the surpluses in well-funded schemes can "boost growth". It should therefore want to avoid making it harder for employers to benefit from well-funded DB schemes before the Pension Schemes Bill measures take effect.

Details

Either approach would require details to be ironed out:

Would it be the first £2,000 of contributions in a tax year that were NI-relieved (even though NI is not calculated annually), or a pro rata amount each pay period?

How would payroll systems adapt to record the split?

If someone who had not been using salary sacrifice starts doing so mid-way through a tax year (for example, after starting a new job) would they be limited to £2,000 or £1,000?

If limiting the amount sacrificed, how would agreements already in place be unwound? (Originally HMRC insisted that any sacrifice was irrevocable, although it has since eased this requirement. However, long-standing salary sacrifice agreements might still include an irrevocability clause.)

Where people have multiple jobs, would the cap apply to each job – and, if not, which employer would be responsible for applying the cap. I.e. would the cap be per job or per person?

Would HMRC be content that a change to the NI treatment of sacrificed contributions constituted a "life event" that could justify amending an existing agreement?

More fundamentally, how would "salary sacrifice" be distinguished from other forms of contract amendment or choice that achieve the same effect?

Navigating the change: new recruits and current employees

For employers who pass part of their NI saving to employees, some of their higher costs will be recouped automatically, with less going into employees' pensions as a result. Where this is not the case, employers might seek to hold down pay growth or to amend benefit packages. When employer National Insurance was increased in the October 2024 Budget, the Office for Budget Responsibility assumed that, by 2026/27, more than three-quarters of the cost would be passed on through reduced wage increases and increased prices.

The changes, at least as reported, only apply to salary sacrifice agreements and not to employer contributions more generally. Unless there are wider anti-avoidance measures, some employers may consider adopting a more bespoke approach to negotiations at recruitment, allowing prospective hires to choose a reward package that includes less salary and more employer pension contribution in the original contract. This would have National Insurance advantages compared to letting those who want to sacrifice salary above the cap or simply pay higher ordinary employee contributions. Some new hires might be particularly receptive to this if they are likely to favour high pension contributions for other reasons, and when contributions are large, (e.g., for an employee on £125,000 who would sacrifice £15,000, a £2,000 cap could increase the employer NI bill by nearly £2,000). For example:

An effective income tax rate of 60% (67.5% in Scotland) applies to earnings between £100,000 and £125,140.

Income above £100,000 triggers the loss of taxpayer-funded childcare

The child benefit taper and universal credit taper also increase marginal rates (though workers on universal credit are much less likely to be looking to sacrifice more than £2,000)

Graduates' student loan repayments are based on NIC-able income – so, if the cap is introduced, they may prefer employer contributions and lower pay to paying employee contributions or sacrificing salary

Replacing existing employees' contracts would be less straightforward but might be worthwhile in some instances. It remains to be seen whether and how legislation will prevent this.

A tangled web

With less than two weeks until the Chancellor's Budget, there is a lot of detail for HMRC officials to get their heads around and drafting the Finance Bill clauses in time for the proposals to be effective from the beginning of the next tax year will present a particular challenge. Later implementation would present the opportunity for a 'closing down sale' and so anti-forestalling provisions might also be required.

All will no doubt be revealed – or not – on 26 November.

|