|

|

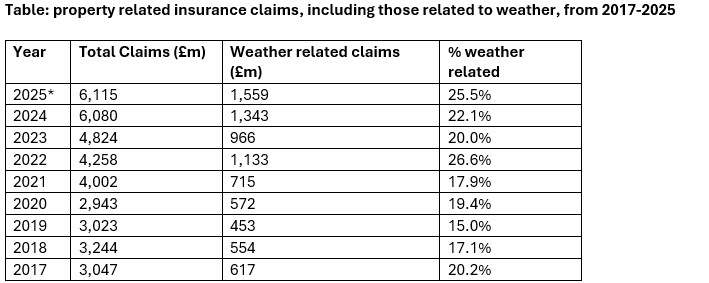

UK property insurance claims are expected to hit £6.1 billion for 2025 – the highest payout on record. Claims specifically related to weather are likely to reach £1.6 billion, double the annual levels seen between 2017 and 2021. Weather claims set to make up 25% of the total amount paid out by UK property insurers in 2025. 84% of home insurance professionals surveyed by Deloitte say that climate change is a risk to their business. |

Payouts relating to property damage in 2025 are expected to reach a new high of £6.1 billion, according to analysis of the UK insurance industry by Deloitte.

Deloitte analysis shows that claims for the final quarter of 2025 (October to December) could total £1.5 billion which, when coupled with previously published industry data, will give a year end figure of £6.1 billion. This is a small increase on the actual payouts in 2024, but up to 50% higher than payouts recorded between 2021 and 2023.

For claims specifically related to weather (floods, storms, freezing, subsidence), Deloitte estimates the full amount paid out in 2025 is likely to reach £1.6 billion. This is more than double the annual levels seen between 2017 and 2021. This figure makes up 25% of the total amount that Deloitte expects UK property insurers to have paid out in 2025.

A recent Deloitte survey found that more than four in five (84%) home insurance professionals believe that climate change is a risk to their business.

Cherry Chan, insurance partner at Deloitte UK, said: “2025 is set to become the most expensive year on record for property insurers. For many insurers, the year has been defined by subsidence claims. Periods of drought last year combined with the extremely wet conditions of 2024 created a perfect storm for subsidence to affect more buildings than usual. With over a quarter of total property claims relating to weather, the industry continues to feel the impact of climate change.

“The UK has already weathered several storms and heavy snowfall in 2026, reinforcing the challenges that insurers will continue to face at the hands of climate change. As the final claims are counted for 2025, insurers will be assessing the impact of ongoing weather events on consumer’s premiums. With premiums expected to fall in 2026, but claims on the rise, the challenge for insurance executives will be to balance the needs of customers with the expectations of regulators, markets and shareholders.”

|

|

|

|

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.