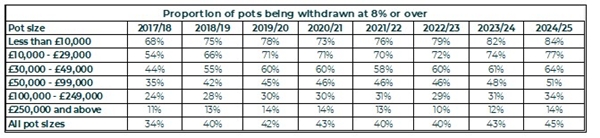

The proportion of pensions being drawn down at 8% or over – nearly twice the rate considered safe and sustainable – has hit its highest recorded level for pots of all sizes according to analysis of the latest Financial Conduct Authority (FCA) data

Broadstone analysed the figures available from the last eight years in the FCA’s Retirement Income Market Data and found that nearly half (45%) of all pension pots were withdrawn at 8% or over in 2024/25. It marks the highest proportion recorded and up two percentage points from 2023/24.

This picture was replicated across all sizes of pension pot with increases of at least two percentage points in every category. The proportion of pensions smaller than £10,000 accessed at 8% or over hit 84% but even amongst the biggest pots – those £250,000 and above – around one in seven (14%) are being withdrawn at over 8%. 4% is widely considered to be a safe and sustainable withdrawal rate suggesting hundreds of thousands of pensioners could be accessing their pension at a significantly higher than recommended rate.

David Brooks, Head of Policy at Broadstone, commented: “This data is cause for alarm in the sheer number of pots that are being drawn down rapidly by pensioners. “While the data does not tell us whether these are retirees’ main pensions that they will rely on for retirement income, it is still startling to see such high numbers rising pretty consistently over the past eight years.

“Similarly, the data highlights current withdrawal behaviour but it does not capture how the rate of access evolves over the long term. Some individuals may be choosing to front-load income in early retirement or meet temporary financial needs, so the headline figures need not imply a permanent, year-on-year pattern. The rising proportion does, however, suggest that this is a trend worth closely monitoring. With pension freedoms just a little over ten years old, we have little to no tangible evidence around how people are managing their pension savings deep into retirement. This data raises the very real risk that many people are depleting their savings unsustainably and risk facing serious financial challenges later on in retirement.”

|