The average quoted price of home insurance rose by 41.6% in the 12 months to April – the highest annual increase since Consumer Intelligence began tracking prices in 2014, the latest Consumer Intelligence Home Insurance Price Index ¹ shows.

There is little evidence of a slowdown either – the past three months saw a 10.3% increase in quoted premiums for buildings and contents insurance which was the biggest quarterly increase for 10 years.

Premiums have most commonly been quoted between £150 and £199 with 24% of quotes falling within that range, Consumer Intelligence’s data shows.

Customers who have made claims could see additional increases in the coming months, Consumer Intelligence warns, with those making recent theft claims experiencing increases in quoted premiums of 13.8% in the past three months.

In the 12 months to April, customers with buildings claims have seen increases of 50.3% while those with water-related damage have seen increases of 49.8%, those with theft claims rises of 43.7% and those with damage related claims have seen increases of 46.4%. By comparison, those with no claims have seen increases of 40.9%.

“The increase in building and contents insurance new business quoted premiums is the largest yearly increase we have seen since tracking began in 2014.

“The market saw inflation during each of the last 12 months and the last three months was the highest recorded in the last 10 years exceeding the 10% in Q3 2023,” says Matthew McMaster, Senior Insight Analyst at Consumer Intelligence.

Long-term view

Overall, quoted premiums have now risen by 68.8% since Consumer Intelligence first started collecting data in February 2014.

Into the regions

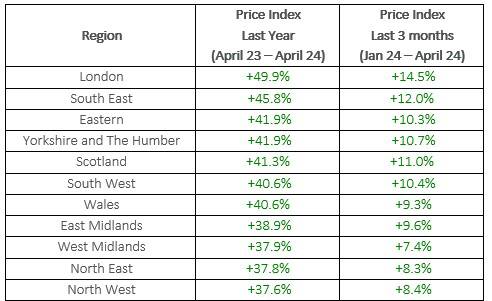

All regions have seen increases in quoted premiums over the past 12 months ranging from 49.9% in London to 37.6% in the North West

Increases in quoted prices over the past three months range from 7.4% in the West Midlands to 14.5% in London.

Age differences

Quoted premiums for over-50s households rose slightly faster than for under-50s households at 42.4% compared with 41.0%.

Over the last three months, quoted premium increases have been broadly similar at 11.3% for over-50s and 9.7% for under-50s.

Property age

Properties of all ages saw big increases in quoted premiums in the past year ranging from 46.4%, which was the highest, to 39.1% for homes built between 1940 and 1955, which was the lowest.

Quoted premiums rose across the board for properties of all ages in the past three months ranging from 12.2% for houses built from 1895 to 1910 to 9.0% for those built between 1985 and 2000.

Data from the Consumer Intelligence Home Insurance Price Index is used by the Office for National Statistics, regulators, and insurance providers as the definitive benchmark of how price is changing for consumers.

|