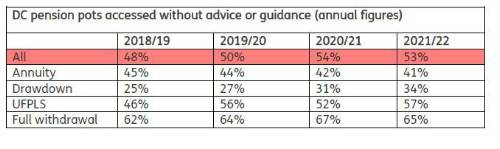

More than half (53%) of the 705,666 defined contribution (DC) pension pots accessed for the first time in 2021/22 were taken by ‘DIY dippers’ making decisions without regulated advice or using the government’s free, impartial and independent guidance service Pension Wise.

Analysis of Financial Conduct Authority figures1 by retirement specialist Just Group shows patchy progress at encouraging people to seek guidance or advice before exercising their pension ‘freedom and choice’.

“From a consumer protection standpoint, it is crucial these figures are closely monitored,” said Stephen Lowe, group communications director at the retirement specialist, Just Group.

“Many hundreds of thousands of pensions are being accessed or emptied without professional support, increasing the risks that pension savers may achieve poor outcomes, pay unnecessary tax or fall victim to scams.”

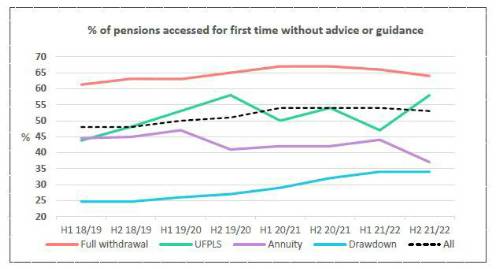

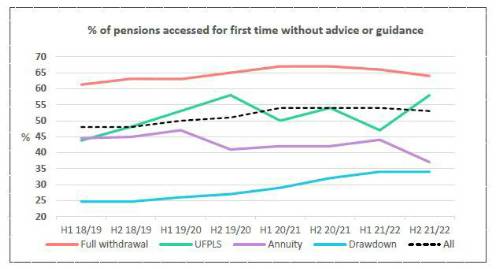

The latest figures show no support given for more than a third (34%) of the 205,641 of pots that entered drawdown during 2021/22, that is sharply higher than the 25% who didn’t get advice or guidance three years earlier.

No advice or guidance was used for around two-thirds (65%) of the 395,237 pensions fully withdrawn, compared to 67% the previous year.

Annuity purchase is the only one of the four options that has seen sustained improvement in the numbers taking advice or guidance. The proportion failing to take either advice or guidance has fallen to 37% in the latest figures, down from 45% failing to seek support three years earlier.

Overall, only about one in eight (13%) of pots accessed for the first time were taken after using the free, independent and impartial guidance service Pension Wise, a fall from 14% the previous year and 15% in 2018/19.

“It raises questions about the effectiveness of recent initiatives to achieve the government’s ambition of making guidance ‘the norm’, such as revised wake-up packs and annuity prompts,” said Stephen Lowe.

“The FCA is hoping that the ‘stronger nudge’ measures introduced in June this year can start to move the needle in the right direction although trials suggest any uplift will be modest at best.

“There is support among policymakers and consumer groups to trial a system where guidance sessions are booked automatically for pension savers. Our own research found only one in 25 people aged 45-54 would opt out of a guidance session pre-booked for them.

“Relying on people to opt in is unlikely to have much effect. This is particularly true among the least engaged and those with low financial capability who on the current data are least likely to use Pension Wise, but most at risk of making uninformed choices, overpaying tax or falling prey to scammers.”

|