As a result, three in five (57%) women aged 25-45 do not have any type of cover that would protect their family should they fall ill or become otherwise incapable of contributing to the household.

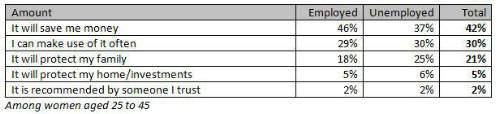

Table 1: What is most likely to make buying something a high priority for you?

Women have considerable influence in buying decisions in their household, as almost half of women (48%) in this age group claim they are solely responsible for the financial decision in their household, and an additional 46% share the responsibility evenly with their partner.

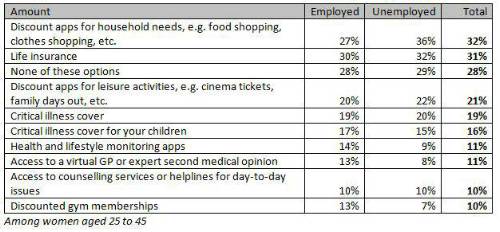

When asked what they would prioritise spending money on, from the options given, a third of women aged 25 to 45 (32%) would prioritise spending their money on discount apps for their household needs such as food and clothes shopping, while a similar proportion would take out life insurance (31%). However, discount apps for leisure activities like cinema tickets and family days out (21%) are seen as more important than critical illness cover, either for themselves (19%) or their children (16%).

The spending priorities for women in this age group change based on whether they are employed or not. For example, only a fifth (18%) of employed women say that buying something that protected her family is a high priority, while 25% of unemployed women say it is.

Similarly, unemployed women are more likely to prioritise spending their money on discount apps for household needs or leisure activities (59%) than their employed counterparts (47%), who were instead on average 5 percentage points more likely to favour health and lifestyle monitoring apps (14%) and access to a virtual GP (13%) compared to unemployed women (9% and 8% respectively).

The findings suggest the current protection gap could be shrunk by enhancing individual protection products with everyday financial support such as discounts and offers, as well as additional health and lifestyle information.

Table 2: Which of the following would you prioritise spending your money on?

Natalie Summerson, National Sales Manager for Individual Protection at Canada Life and a founder member of the Women in Protection group, comments: “With family finances under increasing pressure due to rising inflation and slow wage growth, it is concerning but understandable that so many women prioritise buying long-lasting and money-saving products over spending their money on life insurance or critical illness cover.

“Given the current strain on the household purse, we need to find ways of making protection products as appealing and practical for customers as possible. At Canada Life we have acknowledged this by giving all individual protection customers access to the LifeWorks wellbeing app and website, which provides a wealth of information to help with work, life and everything in between, including retail and cinema discounts. We are continuing to look for new ways to support our customers every day, regardless of whether a claim is made.”

|